Despite Canada’s total lack of leadership in the green economy, a number of key global developments are grounds for optimism heading into the Paris UN conference on climate change.

Global emissions plateau in 2014

In a pleasant surprise for the planet at large, according to the International Energy Agency, global emissions reached a plateau in 2014.

Most importantly, this is not a onetime aberration, but rather an indication that the cumulative impacts of the growing numbers of measures to address climate change in China, Europe and the US are collectively bringing about transformative change. Other key nations such as Japan, India and Brazil have also begun a process that will engender a transformative migration to a green economy.

Particularly encouraging is that in 2014, the CO2 emissions of China – the world’s largest energy consumer – declined for the first time this century, by 0.7%. Behind this incredible achievement, China’s 2014 coal consumption fell by 2.9%, while coal imports declined 15%. This is not a lot, but very significant in that the China has long been associated with rapidly rising emission levels.

Accordingly, China is in the process of changing the global economic/energy paradigm.

China’s race towards a Green Economy

As mentioned in the Common Sense Canadian article “Fossil Fuel Era drawing to a Close…except in Canada“, with the cost of renewables declining, long-term investment cycles of 20 to 25 years already favour renewables. As a result, since 2013, renewables have overtaken conventional fuels in new electrical generation installations and the nuclear sector is reaching something close to a free fall, with plant closures and little interest in refurbishing facilities at the end of their respective active cycles.

A case in point: in just 2014 China’s new installations of wind and solar capacity amounted to 34 gigawatts (GW – a billion watts) of new electrical generating capacity, bringing the total installed capacity of wind and solar energy in that country to 114.8 GW and 28 GW respectively. In other words, China’s new clean energy installations added in 2014 represent nearly 3 times BC Hydro’s entire installed capacity of 12 GW and more than 70% of the total electricity capacity of Hydro-Quebec, 46.3 GW – but China installed all of this new capacity in one year!

As to what all this means in terms of jobs, China has staggering employment numbers for 2014 in its solar PV and wind energy sectors, 1.58 million and 356,000 jobs respectively!

Wind and solar projections boosted

And China promises to do even better in 2015. So optimistic is China on accelerating the pace of new installations of renewables that its National Energy Administration has raised its target for new solar installations in 2015 to 17.8 GW, up from the original target of 15 GW.

Projections for China’s new wind installations in 2015 are such that as much as 20 GW of capacity may be added.

That said, there may be caveat to China’s impressive clean energy projections in that it is not sure if past trends will continue with respect to increases in transmission capacity, lagging behind new wind and solar farm developments.

Regardless, the aforementioned aggressive clean energy initiatives are part of a multifaceted Chinese government war on coal. With respect to this war, as per the US-China climate agreement, China has set targets to the effect that by 2030: 1) 20% of that country’s total energy consumption will come from renewable sources and 2) carbon emissions will be capped. China is also expected to introduce a national cap and trade system in 2016, for the beginning of the country’s next 5 year plan.

Europe: excellent performance on Kyoto

Meanwhile, in Europe, the EU’s original 15 nations have done better than their Kyoto Protocol 2008-2012 GHG reduction target of 8% by achieving a 13.4% reduction below 1990 levels. By way of comparison, Canadian emissions rose 18.5% during the same period.

Furthermore, not only are EU nations on track for meeting 2020 goals of a 20% reduction in emissions, 20% improvement in energy efficiency and 20% energy achieved from renewables, but in October 2014, the EU Heads of State endorsed a 40% emissions reduction target for 2030.

India works towards renewables while increasing access

Not to be outdone, the Government of India has set a target of 100 GW of solar energy and 60 GW of wind energy installations by 2022, which is especially ambitious considering that India’s current total electrical production from all sources combined is only 250 GW.

It is conceivable that India will exceed its targets as clean energy companies have spoken of total commitments of 266 GW of new renewable installations by 2022.

Equally impressive is that the aforementioned goals of India will bring jobs and electricity to regions that either have no electricity or unreliable/unsteady electricity supplies. It is estimated that the solar and wind targets will generate one million and 183,000 jobs respectively, thereby providing boosts to impoverished communities by addressing energy and job deficits concurrently. To-date, approximately 70,000 jobs are attributable to the country’s solar and wind sectors.

Japan: Post-Fukushima

Elsewhere in Asia, Japan’s post-Fukushima Dai-ichi nuclear crisis, which led to the shutting down of 54 nuclear plants and the scrapping of plans to build 14 new nuclear facilities, initially meant a spike in fossil fuel imports, but this was followed by a boom in the renewables sector – supported by the central government.

US #2 on Green Economy, despite Republicans

As for the US, one may be inclined to conclude that the Republicans have put a damper on the progress of non-hydro renewables – yet 47% of new electrical power capacity added in 2014 came from non-hydro renewables. Republicans haven’t succeeded in stopping the Obama administration from doing what it can within existing constraints.

Firstly, there is the question of what contributed to the US having become the world’s number two investor in the green economy after China. The answer begins with the 2009 to 2011 period, under the American Recovery and Reinvestment Act – when the US government laid the foundations for a green economy with a $70 Billion investment.

Today, despite US government support for wind energy being torpedoed: 1) the Investment Tax Credit for solar project development remains intact until 2016; 2) the US government, on an ongoing basis, maintains extraordinary levels of investments in clean tech innovation partnerships with the private and academic sectors; and 3) Obama recently announced a model green government procurement strategy designed to to cut federal government GHG emissions by 40% by 2025. Also worth is the National Renewable Energy Laboratory in Colorado, a veritable beehive of US clean energy global leadership.

By contrast, Canadian green tech innovators and manufacturers face an unfavourably uneven playing field for participation in the high-growth, high-job creation, competitive global green economy – by virtue of the near total absence of Government of Canada support.

Public and private banks back Green Economy

In one of my previous articles, the increasing role of public banks in the green economy was described, with references to the Chinese Development Bank, the World Bank, the European Investment Bank, Germany’s kfw, the UK Green Investment Bank and Brazil’s Banco nacional.

Now, what is new is that private banks are getting into the act, supporting the green economy with dedicated funds. Barclay’s, Bank of America Merril Lynch and Citi Bank are among the new private sector players.

Consequently, with this increasing convergence of public and private banks on green investments, it is estimated that together they will issue $100 billion in green bonds in 2015.

Clean Transportation: California and China lead the way

According to a UBS study, by 2020, customer-side renewable energy production (e.g. solar roof panels), energy storage and electric vehicle charging station technologies – combined with an electric vehicle in the driveway – would offer consumers a 7% return every year with a 6 to 8 year capital payback. The payback would be greater in jurisdictions such as California, which now offers incentives for energy consumers to install combinations of these technologies on their respective properties.

For California and China, the future for zero and low emission vehicles has already arrived. Each has a long list of policies, including aggressive eco-vehicle government procurement targets, subsidies for consumers, support for manufacturing/innovation, generous funding for electric vehicle charging stations all across these jurisdictions and requirements for new/recent buildings to be designed to accommodate ev charging stations.

To this end, California aims to cut petroleum use in the transportation sector in half by 2030 and have 1.5M zero emission vehicles on the road by 2025.

China’s target calls for the domestic production of eco-vehicles reaching 2 million/year by 2020 and a cumulative total of 5 million new energy vehicles on the road by then. Also note that China’s national and regional eco-vehicle policies favour domestically manufactured vehicles.

Meanwhile, in 2016, the new US corporate average fuel economy standards will kick in, requiring that each manufacturer present in the US market achieve an average of 6.2L/100km based on cars sold in that year and 8.2L/100km for trucks. These standards, which are identical in Canada, get incrementally more stringent, reaching a mandatory average of 4.3L/100km for cars by 2025.

However, while these US vehicle standards constitute progress, appearances are somewhat deceiving for two reasons. First, the new standards will allow for the skewing of corporate average fuel economy results by leaving wiggle room in the form of fuel economy by category/size of vehicles sold (based on wheelbase length and track width). Second, the standards include higher consumption allowances for SUVs, considered to be trucks. Together, these factors could translate into higher average consumption/vehicles sold by a given manufacturer than the above-mentioned targets suggest.

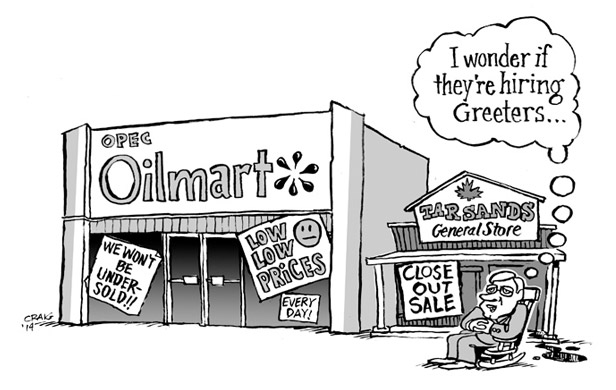

The collapse of the Big Oil business model

While the cumulative impacts of the climate action measures are the backdrop for the International Energy Agency numbers on the plateau in GHG emission levels in 2014, another game-changing phenomenon is also occurring: the collapse of the business model of the oil industry.

This model is based on: 1) demand for fossil fuels continuing to climb; 2) oil prices remaining high enough to justify continued investments in expensive-to-extract unconventional sources such as the tar sands, offshore and shale sources; 3) high oil prices justifying the pumping out of greater volumes of conventional oil to further increase profits; and 4) the growing concern about climate change failing to affect the bottom line.

Until recently, this business model worked like a charm, with Exxon earning $32.6B in 2013, more than any company other than Apple. Well as it turns out, all of the above elements of the business model have hit a wall.

Demand not Rising at the Expected Pace

Not only do China, the US, the EU and India have policies which are lessening the current dependence on fossil fuels, but they all also have policies that will increasingly reduce this dependence. As indicated above, even India, once thought to be a major vector for increased demand in fossil fuels, has targets to change the economic/energy/job paradigm in favour of locally-produced renewable energy.

According to the US Energy Information Administration, 2015 global oil demand had originally been projected to be 103.2 million barrels/day, but this number has been adjusted to 93.1 million barrels/day, thereby undermining the viability of unconventional investments. True, economic slowdowns are also affecting demand, but the shift to clean energy and eventually clean transportation can only increase with time.

Evidently, global actions on climate change are starting to have an impact on Big Oil’s bottom line.

Low oil prices lead to stranded assets, dangerous debt

It now appears that the price of oil might not rise for a long time to come. Low prices cannot sustain the development of tar sands, shale and offshore oil.

This is translating into dangerously high debt loads, with assets being written off in the billions, thus generating a cascade of announcements of abandoned projects around the globe, putting tar sands projects on hold and pushing shale gas companies into bankruptcy. The US shale gas and oil sector now has accumulated a debt of $200B!

How long can this last?

As for the Big Oil premise that concern about climate change would not translate into social change, it requires an extraordinary amount of denial to ignore the emerging paradigm change entailing: 1) the decline in growth of fossil fuels; and 2) political trends favouring more stringent policies in support of the green economy.

Collectively, these factors offer grounds for optimism and hope. And the evidence presented here is only the the tip of the iceberg. Indeed, there are now more than 100 countries that have adopted a target for 2050 to achieve zero net GHG emissions.

What we are seeing is an alignment of the stars which could well lead to real progress on climate change at the upcoming UN conference on climate change in Paris in December 2015.

But in Canada…

Meanwhile, back home, Trudeau and Harper remain wedded to the resource-based export economy, with trade deals to support this dated economic development paradigm. This while our potential customers for increased resource exports are working hard on reducing their fossil fuel dependencies.

On the provincial front, Ontario and Quebec’s participation in the cap and trade (C&T) Western Climate Initiative (WCI), along with California, is helpful, but is also purposely a smoke screen. This is to say that these standalone measures are equivalent to suggesting that one can end poverty with a single policy item. The same can be said of BC’s carbon tax.

In effect, what both BC and Quebec have in common is that their current governments are committed to a resource economy, and are totally indifferent to and/or ignorant of the green economy model. Yet, on a global scale, the green economy is currently, and will be, offering the best economic development strategies of our time, as measured in both jobs and economic growth.

To this effect, Quebec is cutting all the environmental impact corners and investing large sums of public funds to sort out the potential of – and requirements for – the development and commercialization of shale gas and oil, plus offshore oil. This despite the aforementioned $200 billion in debt of the US shale sector and, more generally, the demise of the Big Oil business model.

And while Quebec is applying the above-described devious formula for the “reconciliation” of the environment and the economy, it is abandoning its nascent electric vehicle sector.

BC, for its part, is singularly focused on building outrageously expensive LNG facilities to serve export markets and is justifying the Site C dam for powering these energy-intensive LNG projects. What is amazing here is that BC Hydro’s own analysis indicates that wind power is the lowest-cost option.

Quite the contrast with the third C&T participant, California, with its hefty sets of policy packages to migrate California to a green economy. Even a partial list of the state’s policies on zero-emission vehicles is incredibly long!

What is wrong with this picture?