As the Liberal Government compiles the 2014 BC Budget, it is ignoring warnings of exploding capital borrowing, hiding $100 Billion in taxpayer liabilities, and forcing the province’s least fortunate citizens to shoulder the burden of the province’s appalling fiscal mismanagement – argues independent economist Erik Andersen.

It goes without saying that when governments set about budgeting, they should do so in the “Public’s Interest”. So what are the best ways to do this task? Usually, the conflicting individual objectives are so diverse it takes a general election to arrive at a consensus – much as just occurred in Nova Scotia. The trouble with waiting for a general election is that a great deal of fiscal and economic harm can be done in the interim.

Like many others, the Government of BC has been in denial of post-2009 realities. Even after 20 years of stagflation, Japan has yet to accept the reality of the rollback in corporate shares and property values by more than 70%.

[quote]The true increase in BC’s total liabilities is from $64 billion in 2005 to $170 billion in 2013. In per capita terms, that is a staggering increase in Provincial liabilities of 150% in one decade.[/quote]

BC ignores rating agency’s warnings on capital borrowing and spending

Two years ago the credit rating agency, S&P, publicly advised Canada’s provincial governments to try to control budgets for education and health care, to curtail building large capital projects if debt must be found first and to work on increasing revenues.

Our BC government has been aggressive in limiting the budgets for the first two items; irresponsibly reckless about borrowing and spending on infrastructure projects, and much too timid about increasing revenues in ways that are not regressive taxation strategies.

An examination of historical financial data is one way to get a sense of what might be in store from the 2014 BC budget unless a fundamental change of character emerges.

Revenues not keeping pace with GDP growth

Starting in 2004, the Gross Domestic Product (GDP) for BC was reported to have been $145.763 billion and Total Revenues $29.060 billion. By 2013 these values were $224.823 billion and $42.055 billion, respectively. In that decade, GDP increased by 54% but Total Revenues only by 45%. This shortfall in revenue growth easily explains why the government has had continuing operating deficits ever since 2008 and – if fictional revenue transfers identified by the Auditor General continue – operating deficits will be the order of the day into the foreseeable future.

[quote]BC has a government that prefers for the least financially able carry the burden of annual revenue shortfalls.[/quote]

Parts of the economy that play a large role in determining what is the “public’s interest” – health care and education – have not fully participated in the increase in GDP. In 2004, the per capita amount spent on health care was $2,770 and by 2013 the amount increased by only 35% to $3,750. Spending on education was even more troublesome. In 2004, the per capita amount was $2,040 but by 2013 it had only increased to $2,470 – or a 21% rise.

Electrical consumption remains flat, job growth slow

What about the rest of the BC economy? Electrical energy could be thought of as an indicator of social and business activity in the province, yet total sales to BC-only customers by BC Hydro remained stagnant at 50,000 GWhrs per year. Even the total of employed citizens came nowhere close to matching the increase in GDP, only a 15% increase over the decade.

BC’s citizens left out of GDP growth

So, why, might you ask, are BC’s citizens being left out of enjoying the benefits from this run-up in the Province’s economy?

There are two possible reasons. The first is that the Government has not been able to stop “leakage”, if indeed it even tried. The second has to do with one of the items mentioned by S&P – unaffordable borrowing and spending on infrastructure, particularly by BC Hydro.

Auditor General calls out fuzzy math in BC budgets

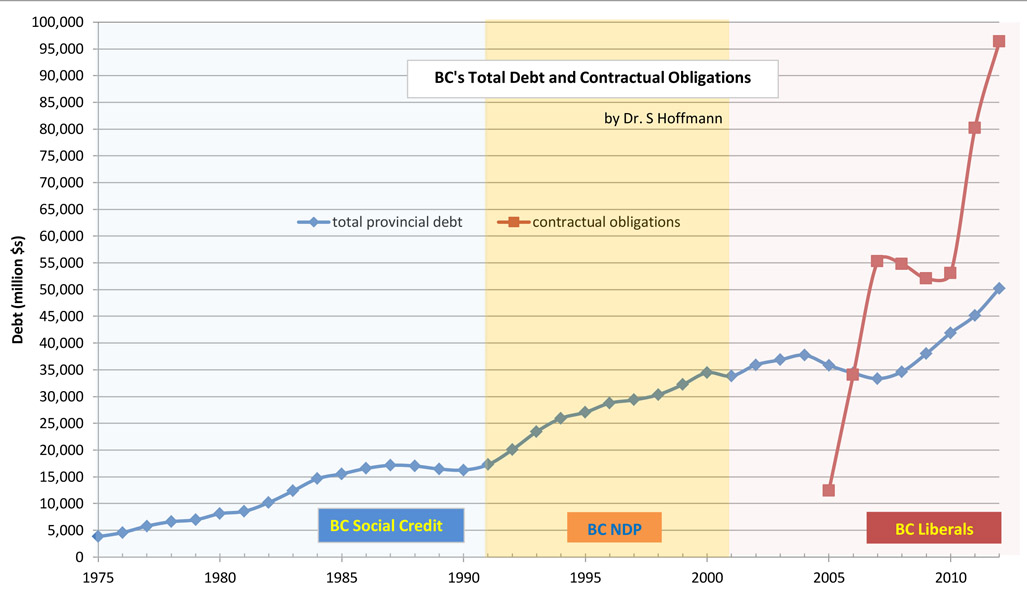

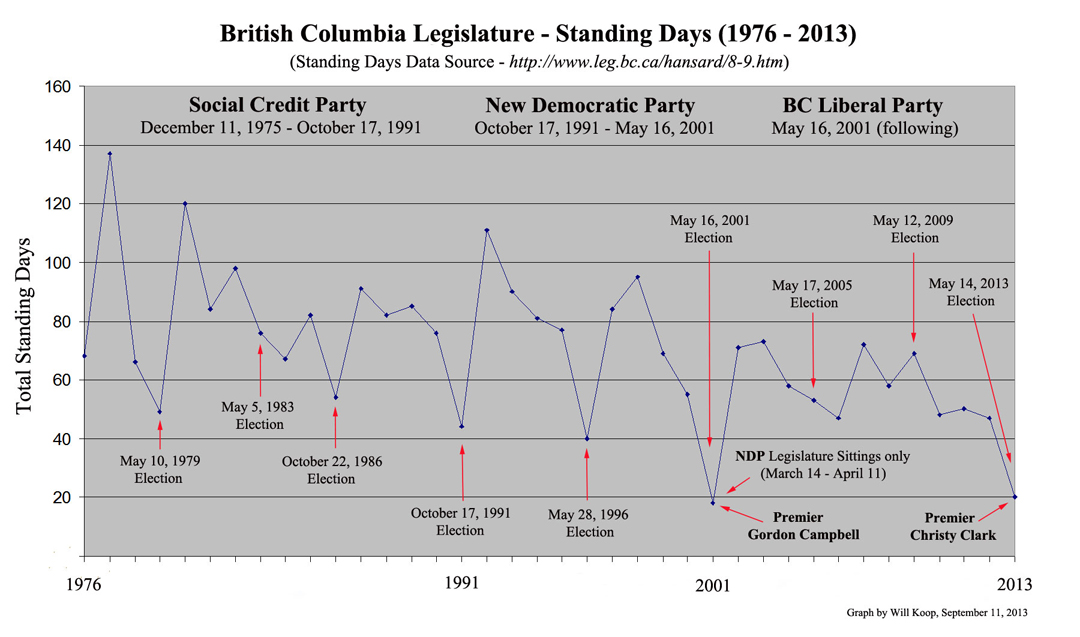

BC’s Government likes to “word-play” around the topic of debt and contractual obligations, a sort of Enron-Nortel approach to financial reporting. Each year the Comptroller General reports on the province’s financial condition and the Auditor General does a review. Without fail there has not been one year in the past decade that the Auditor General has issued an unqualified audit, short form of saying not right folks.

So back to debt or whatever some in Victoria like to call it. Formally, the Comptroller General reports annually the province’s “debt” and other liabilities. The political practice is to focus on the number in the “debt” column. In 2004 it was $37.735 billion and as of 2013 the “debt” was $55.816 billion. Not an altogether bad picture, right?

$100 Billion in hidden liabilities

Next, the Comptroller General shows “Liabilities”, which mostly don’t go away and are now $19.5 billion, up from $15.216 billion in 2004. What the Comptroller General does not show is a third category of liabilities known as “contingencies and contractual obligations”. The first reported year for this category was 2005 when the amount was $12.392 billion. Since then this addition to Provincial liabilities has exploded to over $100 billion (1).

All political parties running candidates in the recent election knew that the Auditor General reported the total in 2012 at $96.374 billion but none would talk about it.

Adding these three liabilities together, the increase in the provincial total is from $64.273 billion in 2005 to $170 billion in 2013. In per capita terms, that is a staggering increase in Provincial liabilities of 150% in one decade.

Citizens shoulder debt burden of BC budget

So what does the trend of the past decade suggest?

BC has a government that prefers for the least financially able carry the burden of annual revenue shortfalls.

We have a Government addicted to being big borrowers and spenders, “air-brushing” away exploding provincial liabilities. A borrow-your-way-to-financial-success model of management.

We have a government in total denial of the economic risks prevailing in the global economy of 2013 and beyond.

Not much “public’s interest” in the continuation of the government’s recent fiscal practices and little cause to think they will change.

(1) In the absence of a formal value for “contingencies and contractual obligations” the amount assumed is $100 billion for 2013.

[signoff1]