During a recent state visit by Canadian Prime Minister Stephen Harper to Malaysia, host PM Najib Razak pledged a “gargantuan” investment of $36 Billion for gas infrastructure in British Columbia, through national energy company Petronas.

The Sunday announcement comes following last year’s controversial $5 billion-plus takeover of Canadian company Progress Energy and early-stage plans for a pipeline and liquefied natural gas (LNG) plant near Prince Rupert, on BC’s north coast. It also marks the first tangible “final investment” commitment from any of the dozen or so LNG proposals that have flooded BC over the past couple years, involving more than 20 local and international players.

While companies like Chevron and Apache have together ponied up $500 million for engineering, surveying and early construction work (Chevron and Apache’s joint venture in Kitimat is the only one so far to obtain required permits), none have taken the plunge on the tens of billions required to follow through on their pipeline and LNG plans.

$36 Billion – that’s a lot of ringgits. If it were my state-owned energy company, I’d want to be darned sure my investment was justified.

So here is a little unsolicited investment advice for Mr. Razak, free of charge.

We don’t actually have all that gas

If you listen to BC’s Minister of Natural Gas Development, Rich Coleman, BC has discovered a magical, bottomless well of gas – through the controversial, new extraction method of hydraulic fracturing, or “fracking”. Mr. Coleman may indeed have a boundless source of fuel: it’s called hot air.

While we’ve uncovered new supplies in northeast BC, trapped in shale formations deep underground, the numbers being quoted by the likes of Coleman are wildly out of touch with reality.

I put Mr. Coleman’s figures from a recent speech at the Union of BC Municipalities’ annual convention in Vancouver to one of Canada’s top independent shale gas experts, David Hughes. Mr. Hughes is a recently retired 32-year senior geoscientist and manager for the Geological Survey of Canada. He led the development of the federal government’s coal registry and was team leader for unconventional gas on the Canadian Gas Potential Committee.

In short, the man knows what he’s talking about – and he’s not speaking for industry or government.

In his speech, Coleman boldly predicted BC has enough gas to supply 5 LNG terminals for 84 years – on top of local needs and sales to Canadian and US customers – while using only 30% of our known reserves.

As Mr. Hughes counters, drawing on data from BC’s own Oil and Gas Commission (you’d think the minister would check his own government’s figures!), that statement represents an exaggeration of about 4000% from our real known reserves:

[quote]To put it bluntly, BC has 34.6 tcf of reserves in the bank and Rich is counting on 1365.4 tcf of undiscovered gas to be discovered and recovered, to cover his LNG projects and commitments to North America…[/quote]

Surely, there will be new discoveries to come – particularly in the yet untapped Liard Basin, where Apache claims to have found monster reserves through recent test drilling – but that’s not what Mr. Coleman is saying when he uses the term “known reserves”. Moreover, the idea that we will discover 40 times more gas – let alone that all that proves recoverable – simply stretches the imagination.

Even if Petronas was the only LNG project and pipeline (one of four major ones proposed) to go forward, the availability of gas required to fill these demands and justify this kind of investment is highly questionable – nay, darned near impossible.

At the moment, BC produces about 4 billion cubic feet/day (bcf/day) of gas. The capacity of Petronas’ proposed pipeline, to feed its LNG terminal with gas from northeast BC, is 2-3.6 bcf/day. That means an increase of half to almost all of the gas produced in BC today, just to fill Petronas’ pipeline and plant.

Minister Coleman’s answer to skeptics? “I’m an optimist!”

That’s all good and fine – I just hope the decision-makers in Malaysia have a few realists on the payroll.

Fracking’s unprecedented decline rates

Even if it were possible to fill Petronas’ pipeline in the short term – again, assuming it beats out all its competitors to secure this supply – Prime Minister Razak acknowledges this project is a “long-term” investment.

The experience of Amercian fracking companies – the first out of the gate with this technology – should raise some big, red flags. Today, some of the major, early fracking booms south of the border are going bust – in places like Pennsylvania’s Marcellus shale.

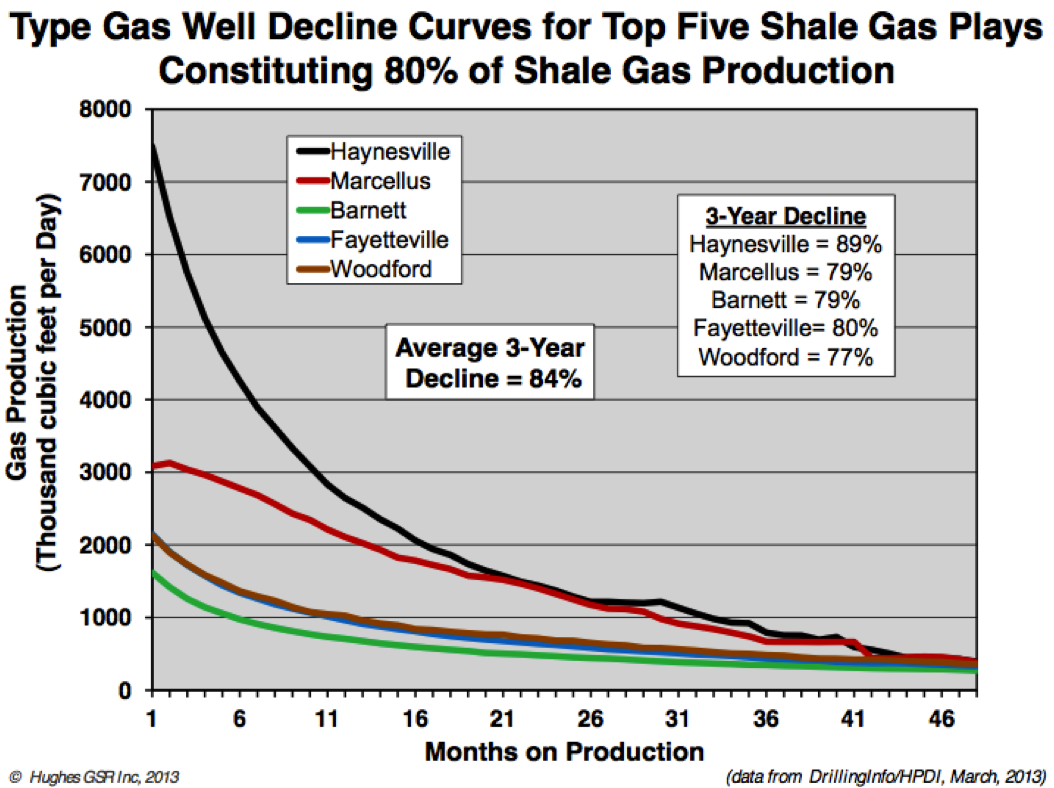

Why? As Hughes points out, after analyzing years of actual wellhead and production data, the decline rates for unconventional shale gas are far steeper than they are for conventional supplies – of which we’re fast running out. The top 5 shale gas plays in the United States, which account for 80% of all shale gas production, are seeing an 84% decline rate over 3 years. That means that while plays like Petronas’ north of Fort St. John, BC, are pumping out large volumes today, they may quickly dwindle.

These are US figures – we won’t know until more specific BC wellhead data is analyzed just what decline rates look like here. Nevertheless, this should ring some alarm bells.

Mr. Hughes says that just for America’s shale gas production to remain flat – keeping ahead of these huge fall-off rates – would require 7,600 new fracking wells every year, at a cost of $42 billion. So Mr. Razak’s $36 Billion might not go as far as he thinks.

LNG’s exploding costs

It’s not clear how earlier discussion of a $20 Billion investment in BC gas infrastructure ballooned to $36 Billion with this announcement, but it may be a prudent reassessment.

This kind of infrastructure has a history of ballooning budgets, as we can witness with Australia’s massively over-budget Gorgon plant, being built by Chevron. As of last year, the project had exploded to $52 Billion form original estimates of $37 Billion – and at that time it was still 18 months away from completion. So be prepared to chip in some extra ringgits on top of that $36 Billion.

Environmental issues

Most of this new gas would have to come from what Mr. Hughes calls “a very aggressive increase in the number of fracked wells in northeast BC.” Fracking has ignited a wave of protest around the world – particularly in the US – driving bans and moratoriums in dozens of jurisdictions. While concerns in BC have remained relatively muted so far, Canada is already seeing a strong reaction to the controversial practice.

Quebec passed a moratorium last year, and in New Brunswick, opposition from local aboriginal communities and their supporters is heating up fast, forcing a meeting with the province and RCMP. Quebec’s moratorium has led to trade strife, with a NAFTA challenge launched against the province last week.

In the Yukon, First Nations recently passed a resolution against fracking over concerns for its impacts on their water.

How long before BC joins this chorus of fracking protests? With evidence of water contamination and air pollution impacts mounting, can BC remain an opposition-free haven for shale gas for the decades Malaysia requires to recoup its investment?

Indigenous opposition

Surely, Malaysia’s energy advisors are aware of the impact First Nations opposition to the Enbridge Northern Gateway project has had on that proposed oil pipeline and terminal’s prospects.

While the perception is that BC’s First Nations are largely supportive of fracking and LNG so far, beneath the surface, there are already cracks forming.

I recently interviewed a hereditary chief whose nation is steadfastly opposed to all pipelines proposed to cross its territory, which includes Enbridge and two gas pipelines. Petronas may be able to skirt this particular 22,000 square km territory with its pipeline routing, but that assumes neighbouring nations don’t follow suit.

In northeast BC, where Petronas gets its gas, there are mounting concerns among First Nations over the impacts of fracking on their local waters.

All it takes is serious opposition from First Nations at one of the many points along the gas’ trajectory to tankers on the coast and Malaysia’s massive investment will be put in real jeopardy.

Getting off on the wrong foot with disappearing river

Petronas still needs to receive environmental approval for its proposed pipeline and plant – and that may prove more difficult than it assumes.

The company began by trying to evade environmental review altogether – a ploy that failed. Then, it made a major misstep when it erased Canada’s second largest salmon river, the Skeena, from its project description.

After The Common Sense Canadian and other media outlets took the story public from a release by West Coast Environmental Law, the Canadian Environmental Assessment Agency agreed to extend the public consultation period on Petronas’ draft plan – acknowledging the mistake and inserting a proper map into the project description.

The terminal would indeed pose a serious threat to beleaguered Skeena salmon stocks, encroaching on important estuary habitat. Some upstream First Nations were forced to cut their food fishery this year for the first time in memory as a result of collapsing stocks.

The message to Malaysia is this: Canadians care a great deal about their salmon. Don’t expect this plant to sail through environmental assessment, and even if it does, don’t expect an easy ride.

Treading on Bear Country

Petronas faces another environmental battle over its proposal – the plan to bisect a the Khutzeymateen Grizzly Sanctuary. This special section of protected bear habitat lies in the path of Petronas’ proposed pipeline to the coast, a fact that has angered some of the province’s top bear biologists and already stirred up controversy in the media. Petronas should ask Enbridge about its experience infringing on BC’s Great Bear Rainforest to get some idea what kind of backlash awaits their project over the pipeline route.

Finally, with local air pollution concerns being raised and citizens beginning to delve into the enormous potential impacts of LNG – as I observed on a recent speaking tour through five northwest BC communities – companies like Petronas will face mounting opposition to their plans.

A little food for thought for Prime Minister Razak before he plunks down all those ringgits.

LNG and fracking are risky business.

[signoff1]

Your qoute of the ” The experience of Amercian fracking companies – the first out of the gate with this technology ” is so far from the truth. We have been fracing in Canada for decades now and it is the Americans that have adopted our technology. Except they do it as cheap as possiable and have environmental incidents just for that reason. There is way more gas in Alberta than we can handle, and with another market besides the one to our south Canada will prosper. I am not saying this because I read it somewhere or heard it from some one. I am actually sitting on a rig at this moment and know first hand. Thank you and have a great day.

Ok John, let me be specific – the unique combination of fracking, deep directional drilling and chemical cocktails pioneered a little over a decade ago in the Barnett Shale. When I say fracking in this context, I mean the modern understanding of it.

As for available gas, yes, Alberta’s reserves could form some of the supply for these LNG plants and pipelines, but not nearly on the order BC’s Minister of Hot Air boasts.

Great piece Damien,

We know its not news that Petronas has been in the play, but there has been very little debate about SOEs developing our resources and what that all entails for them and us.

Malaysia liquidated their own reserves, are addicted to the revenues and are searching abroad for rich sources like ours to continue supplying the folks they have committed to and provided cheap product to until theirs ran out. However the new sources have to be on the cheap, essentially the equivalent of what it was when they were exploiting their own resources, and that is the onus of the Petronas situation.

36 Billion sounds like alot and it is a whole bunch of ringgits no doubt about that, but what it means is that Malaysia needs revenues, and that means no revenue stream to BC’s “prosperity” fund. Its theirs or ours, and I would suggest that the 36 Billion ringgits says the “prosperity” is theirs.

Very true, Kevin. With changes to our labour laws to incentivize foreign temporary workers – allowing companies to pay them 15% less than equivalent Canadian labourers – we’re likely to see the Petronases of the world reap most of the benefits from our own gas resources.

With the continual race to the bottom on royalty revenues to attract LNG investment away from our competitors, which you highlighted in a piece last week, we can expect the real “prosperity” to flow beyond our borders along with the gas.

https://commonsensecanadian.ca/bc-lng-will-powered-massive-taxpayer-giveawyas/

Agreed, and as the Hughes charts show the liquidation of the resource occurs very quickly with fracking technology.

In Australia for instance, they negotiated royalty breaks that saw “no charge” on wells in the first five years, as you can see, their depleted by that point, which means they gave the gas away.

This was done to incentivize the expensive build outs. Be prepared to see the same kind of thing here (we already have, but prepare for more). This is also where over estimating supply and reserves comes into play. If the likes of Coleman continue to claim 4000% more reserves they only do so in order to grease the skids for upfront giveaways to subsidize infrastructure and keep promising prosperity around the corner some time in the future.

Moreover, just as in Malaysia where they have been the worlds second largest exporter behind Qatar, they also import to other regions of their country, and look how small their country is. The point here is that those importing regions often pay the going export rate, which means we will see something similar here, which Australia is also experiencing.

IOW, pricing for domestic consumption in “Gas Rich” BC, will be just as high as what these companies fetch on export markets. Translation is: no domestic benefit for exploiting our gas, even though we are forced to give it away to build the export facilities they require to fetch that higher export premium.

Its not even a zero sum game, its a shell game, where the profits are privatized, losses socialized, environmental degradation foisted upon the regions and water resources depleted and poisoned. The jobs will indeed as we have documented in great detail and have seen with inviting US expats and war veterans invited into the domestic industry.

Its insane really and could well be our demise, I know, I know its not very positive, and I should take Colemans lead and get out my copy of ” the secret” and just wish for wealth to appear, but as you say, its the damn realist in me – root word reality – that keeps getting in the way.