What was touted as a $36 Billion investment commitment by Malaysian LNG giant Petronas is actually a massive giveaway of natural gas by BC – valued at up to $400 Billion gross over the 25 year term of a secretive export licence being negotiated behind closed doors.

The headline blared out in the Globe and Mail earlier this week: “BC Minister says Malaysian investment vindicates Province’s bets on LNG sector”

The Petronas announcement by Malaysia’s Prime Minister on Sunday “was pretty broad”, Coleman acknowledges, but he maintains it should be enough to put the rest the naysayers who claim he is simply pursuing a pipe dream.

The announcement comes as Coleman is about to depart for a whirlwind tour of Southeast Asia to promote BC LNG – including a trip to the world’s tallest twin towers, Petronas’ home base.

Petronas has long been at the table in BC and probably tops the long list of companies Coleman has signed non-disclosure agreements with, and we are beginning to see what those NDAs include.

Coleman has still not publicly admitted to having them and no reporter has reported on them but Coleman refers to them by saying he is having “very detailed confidential” negotiations.

Photo-op with Malaysian PM delivers nothing new

The Prime Minister’s photo-op announcement with Canadian PM Stephen Harper was therefore nothing new, but what was “newsworthy” was the dollar figures thrown around.

Not long ago, in a firestorm of controversy, Harper approved Petronas wading into the BC LNG market with a takeover of Progress Energy under his “new” foreign investment policies, which specifically forbade foreign state-owned enterprises (SOE) from taking over whole-cloth domestic-based companies – but Petronas was already in the door.

The focus has been, as many headlines exclaim, that Petronas is investing 36 billion dollars in BC LNG. Let’s take a closer look.

The real numbers

The Malaysian SOE has been the world’s second largest exporter of LNG behind Qatar. The oil and gas industry makes up 20% of Malaysian GDP. Fully 63% of their exports go to Japan.

Malaysia has therefor been quickly depleting their own resources and are fully dependent on the revenue streams from LNG – in fact, some regions of the small country actually import LNG and they have re-gasification projects underway in those jurisdictions.

Therefore, in order for Malaysian LNG to remain at the top of the game they need access to a cheap supply of gas, mostly, as we have seen, to continue to supply Japan, which may explain why Japan has a 10% interest in the Petronas BC LNG play.

And a play it is. The only new information Harper’s photo-op revealed was the investment figure of 36 billion dollars. This prompted Coleman to start foreshadowing the details of the “prosperity taxation regime” his party was re-elected on and British Columbians have long awaited.

Coleman selling snake oil

“We’re very close to that sweet spot,” the LNG minister said, noting he expected that details for the LNG Royalty Regime will be released in November.

[quote]We’re going to have to lock it down with some complex legislation to make sure people know there is some certainty around their investment in British Columbia so someone can’t come in and arbitrarily change it after you have made billions of dollars in investment in British Columbia.[/quote]

“Sweet Spot?…Lock it Down?” Wait a minute – this is not sounding very good and certainly nothing like the $100 Billion prosperity fund that will erase debt, lower taxes and provide vital services, which the Liberals campaigned on.

In fact, it is sounding a lot like trade and investment agreements where deals are negotiated in secret and the corporate rights they establish, including the worlds lowest royalty rates, are “locked in” for a generation.

Coleman goes onto claim that “We will not be beaten by anybody with regard to fundamentals.” Translation, we will be the cheapest operating district in the world by charging the lowest royalty rates, providing the best subsidies and tax breaks, and offering the least government intervention on issues related to the build out processes and pipeline approvals, including environmental protection.

Oddly, Coleman claims that locking all this in, much like the Chinese FIPPA agreement does, is an imperative and must be done to secure the investment and provide certainty. However the 36 Billion dollar figure from this one SOE, is an estimated figure over 30 years and requires no such up front commitments as it is Petronas who need access and we have at least 12 companies lined up for our supply.

No Final Investment Decision expected until end of next year

It gets worse. This “vindication” of Coleman is still not a Final Investment Decision (FID) – when a company truly ponies up the big bucks. In fact, Malaysian newspapers touted it as a step to securing a MASSIVE 25-year export license for 19.68 million tonnes a year for 25 years. That is one hell of a lot of fracking gas.

The headline in the Malaysian Business Times is much different than all the headlines in Canada – it reads: “Petronas Eyes Canada License“. The first line of the story claims the export license is required before any investment talks can move further.

Far from vindication, the Malaysians see their 36 billion dollar carrot as a play to secure our huge, massive, longterm supplies at rock-bottom prices, with a royalty “sweet spot”, formerly known as a regime, that is the lowest in the world.

So there will be no commitment on this deal unless we roll over and hand over hundreds of billions of dollars worth of natural gas to them – then and only then will they take the “next step.”

Therefore, Canadian headlines claiming this is vindication and a done deal that is worth 36 billion could not be further from the truth. This is not an FID. The 36 billion dollars is an estimate ranging over 30 years into the future, which is not guaranteed, and involves everything from pipelines and infrastructure to all sorts of other anomalies, otherwise known as bullshit.

This “vindication” of Colmean is just more evidence that vindicates my long-held claim that our governments are the worst negotiators on the planet.

The Math

Why is Harper embarrasing himself in Kuala Lumpur, being overshadowed by a state visit from the Chinese President, coinciding with his time in Malaysia to re-announce an old deal?

Its all in the math.

The only thing new being announced is the dollars involved, and the play is on us as Petronas desires one thing: certainty. Translation: locked-in royalties and a license to export.

We have to wait until next month to hear how Coleman sold us out on the royalty “sweet spot”, but we can do the math now on the HUGE sellout we are seeing with respect to the export license.

Hold on to your hat.

Petronas is applying for 19.69 million tonnes a year for 25 years. There will be no FID without it. To put that in perspective, this one export licence would be for roughly the same volume as the entire annual LNG exports for Australia – a major player in the industry, far more developed than BC.

Let’s unpack that and see what kind of return a promise of $36 billion over 30 years gets a foreign SOE, shall we?

1 ton = approx. 50 million BTU (MMbtu – the standard tradable unit for gas)

20 million tonnes = 1 Billion MMbtu

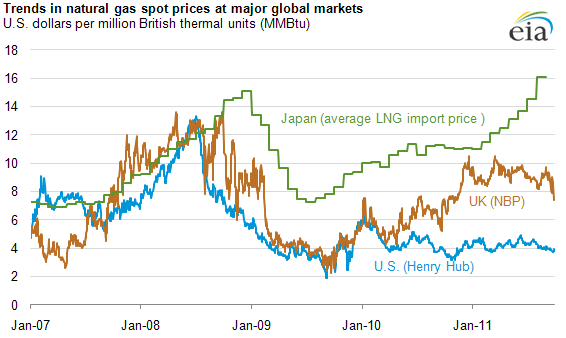

Now look at this chart of going rates per MMBtu:

According to this chart, the export license Petronas demands before it will spend a nickle is worth at least $4 BILLION a year (gross). That’s based on roughly $4/MMBtu on the domestic Henry Hub market, times 1 Billion units.

That’s on the low end, based on North American values. The whole point of exporting this gas is to achieve a higher price on the Asian market – so the real value is likely much higher.

Up to $16 Billion a year

On the high end, remember 63% of Malaysian LNG exports go to Japan and Japan has a 10% stake. Based on current values of roughly $16/unit in Japan (the whole point of exporting LNG to new markets), that means more like $16 Billion/year (gross)

Yes, $16 Billion dollars per year for 25 years, all to secure an investment of 36 billion over 30 years.

In other words, Petronas wants an export license valued between 100 – 400 Billion dollars, to secure 36 Billion dollars in investment.

“Sweet spot” indeed!

[signoff1]

I was at the FN LNG Summit …. and I think the whole LNG hype-up stinks!!

The FN of northern BC have the power to expose this selling-out of our bc resources/wilderness/way of life … the FNs of NE BC whose land is the “sacrificial lamb” for LNG profits and the coastal FNs whose ocean food security is directly threatened by the LNG plants are suffering with inadequate capacity to deal with this high powered corporate take-over and behind-door dealings … keep investigating these crooked dealing Kevin & Damien and inform the BC citizens because I think this goes against the collective moral standard of most Canadians. … independent media MUST make counterpoints to the LNG whitewashing in the mainstream media….

What do we do to stop this. Why do we allow our “government” to negotiate away our public wealth in secret for peanuts . This is what society in BC has devolved into . Normal people struggling to make ends meet while the liberals add massive amounts of debt and give away our natural resources for free . How many billions of litres of our water will they get to use for free, pollute and pump back under the ground like its some kind of earthen rug . Its like watching a group of people break into your house and slowly rob you blind .

Could this be why Minister Coleman wasn’t at the Carrier Sekani’s LNG Summit? Because he was preparing … Rich, is right.

Were you at this week’s summit, Chief Walking Eagle? If so, I’d be very curious to hear your thoughts…