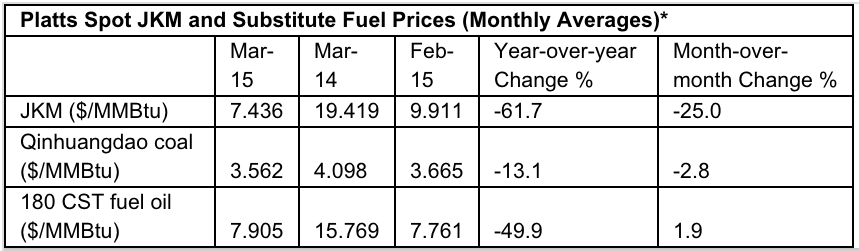

Asian spot market prices for liquefied natural gas (LNG) have plunged by a single year record of 61.7% since February 2014, according to Platts JKM (Japan/Korea Marker) – a leading source of benchmark prices for the industry.

Average prices for March delivery peaked at a historic high of $20.20 per million British thermal units (MMBtu) on February 14 ,2014. By February of this year, prices for March delivery had tumbled to$7.44/MMBtu – representing the largest year-over-year drop since Platts began tracking the market in 2009, and the lowest benchmark price for Asian LNG since 2010.

Said Stephanie Wilson, managing editor of Asia LNG at Platts:

[quote]Moderate temperatures and high buyer inventories continued to cap demand for spot cargoes in northeast Asia, despite the lower prices in March. Exacerbating the oversupply were cheaper competing fuels, which many utility power generators opted to burn rather than LNG.[/quote]

Taking its nuclear reactors offline post-Fukushima, Japan drove up LNG prices from 2011 on, sparking a global race to supply the Asian market with LNG. But subsequent weakening demand, increased competition and lower oil prices – to which Asian LNG prices are indexed – have all exerted significant downward price pressure on the resource.

What is the Clark government thinking?

This should leave British Columbians doubting the wisdom of betting the province’s economic future on Asian LNG exports – underscored by one after another global energy player backtracking on its investment plans.

These prices match up perfectly with predictions of two years ago by business news leader Bloomberg, which foresaw precisely a 60% drop in Asian LNG prices – the only difference is the speed at which the drop has occurred. Bloomberg saw it coming by 2020. In the same story, Bloomberg calculated this would mean a $6 million loss per tanker, pegging the break-even point for shipping LNG from North America to Asia at around $9/MMBtu (in some of Northern BC’s shale gas plays, this figure can be as high as $10-13/MMBtu). With current Asian LNG prices, we are already well below that point, calling into question the entire business case for BC LNG.

Yet, somehow the Clark government remains bullish on the industry, leaning heavily on future anticipated revenues in its recent Throne Speech.

Damien, I appreciate your research. It plays a valuable role. The question – if we as corporations, governments and people are long on natural gas (as a much friendlier to the environment means of buoyant L/T energy supply), truly understand future global demand (decline in coal/oil, increase in gas) and see natural gas as a viable bridge fuel for the next few generations (until the world figures out commercial alternate energy supply) then what does today’s gas price have to do with a 30 year signed contract that these BC LNG projects start collecting on (at the earliest 2020-2050)?

These are global companies that have drilled for, built LNG facilities, bought/sold (imported/exported) and have transported LNG globally since the 1960’s in some cases. Can you tell me what the price on Natural Gas will be in 15 years? As I understand it, more of the basis for ROI calculations (mid point of 30 yrs.) for new projects. I don’t think anyone can predict the future.

I would rather be proactive in securing our future than miss a multi-generational, nation building opportunity like we have in front of us because of short term pricing. Were the railroads built across Canada in late 1890’s financial successes? These are 50-100 year or more projects (longer in the case of railroads). Is your concern more over supporting fossil fuel based development or economics? If we don’t build these plants, which we still need to do a huge job of making economically viable, then someone else will. Would you prefer Russia build the 10 projects that they have on the books? I know my answer.

Respectfully !

Well said Stevo,

But, how much of the LNG will be from Fracking?

I dont have a problem with Nat Gas from Alberta that is sitting underground in its gaseous state. Gos only knows they have oodles of it.

I do have a problem with gas that is forced out of the ground by pumping hydraulic chemicals at incredible pressures deep underground.

How long will we have to wait for THAT Pandoras’ Box to come back and poison our drinking water?

Now? Tommorrow? 5 years? 10?

There are old abandoned gold mines in Nova Scotia that have ruined the water supply for communities forever.

http://www.google.ca/url?sa=t&rct=j&q=&esrc=s&frm=1&source=web&cd=3&cad=rja&uact=8&ved=0CCkQFjAC&url=http%3A%2F%2Fdalspace.library.dal.ca%2Fbitstream%2Fhandle%2F10222%2F14064%2Fv32_p4_a5_Dale_Freedman_Arsenic_in_goldmine_tailings.pdf%3Fsequence%3D1&ei=lJLmVLu-BsuoogSbxIDYDg&usg=AFQjCNG3vhoURWs1f6SdgXKTKa88TuxTNQ&bvm=bv.86475890,d.cGU

Good luck getting compensation from a long gone fracking company or its numbered subsiduary.