Why has BC Hydro gone so Big?

Over the past few years a number of us have puzzled over this question. The Crown Corporation, in most people’s minds, was given its natural monopoly status in the belief that the Board and Officers will prudently manage Hydro’s assets so as to deliver adequate electricity to British Columbians at the lowest rates possible. For decades this seemed to be what happened, making BC the place in North America with the lowest electricity rates. It was held to be an achievement to celebrate and certainly gave our province an energy edge when it came to attracting new businesses. This is fast becoming no longer the case.

Let’s take a look at the record. In 2000 total assets were $11.596 billion; by 2011, assets had ballooned to $19.479 billion. In 2000, total liabilities were $9.320 billion; by 2011 they too had ballooned to $16.599 billion. If one were to add the yet-to-be-collected amounts held in the “Regulatory Assets” accounts (money we owe as ratepayers) that BC‘s Auditor General discovered, BC Hydro would be negative equity, more liabilities than assets.

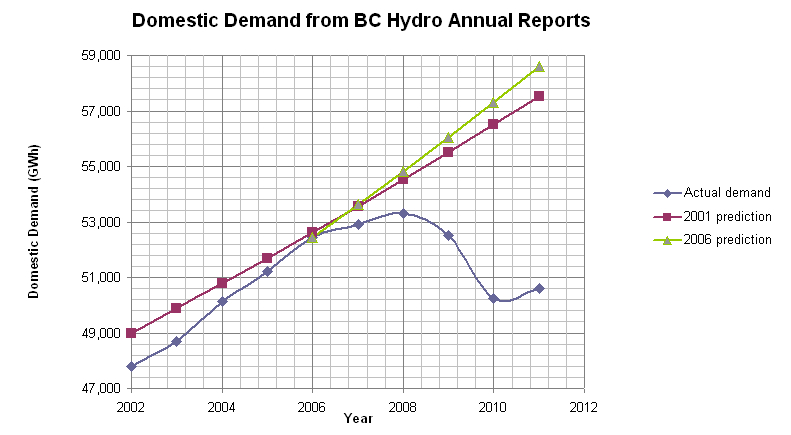

Had there been a matching increase in demand it would make some sense but in the chart below you can see that has never been so. For several years the unanswered question has been: How could financially literate people steer our crown corporation on such a perilous course? The enormity of this financial fiasco places the prized assets of BC citizens directly in harm’s way with no credible explanation as to why.

Through the decades BC Hydro has consistently shown a passion to have more generation and transmission capacity than was ever necessary to fulfill its real purpose of satisfying its BC customers. In support of this assertion please consider the Chart below (credit: Sandra Hoffman, PhD.).

The forecasts for all businesses are corporate manifestations of a course to be navigated. Forecasts drive investment planning and by extension, borrowing.

In his 1999 book, White Gold: Hydroelectric Power in Canada, Karl Froschauer , writing about BC Hydro, stated “By the early 1980s, the ‘unplanned surplus’- the equivalent of the entire capacity of the $2 billion Revelstoke dam (1,843 MW)- became evident, and BC Hydro was called to account for its planning decisions. The statement of Robert Bonner, BC Hydro chairman at the time, was reported as follows: ‘ Hydro was merely responding to what its corporate customers thought they would need. He said those industries could not have forecast plant closings and the general slump in the economy that resulted in a drop in the demand of electricity.’”

It is worth borrowing a military concept at this point. The best commanders are those displaying “situational awareness”. It is part of the art of valuable leadership. Chairman Bonner was simply excusing himself and his management team from their dearth of “situational awareness”. There are numerous indicators to call upon plus more than a hundred years of formal economic literature that would provide “situational awareness” for those wishing to avoid making “stranded investments” – those investment that no longer can produce revenues but still must be paid for.

Mr. Froschauer goes on to write that “There is no evidence that these companies were held responsible for not purchasing the electricity for which they had made firm inquiries…Upon revising and reconfirming the inquiries made by potential industrial customers, BC Hydro found that its estimates were now less than half of the original forecast.”

BC Hydro forecasts have consistently being far too optimistic because the corporate leadership and Governments have sought to turn electricity into an export product, forgetting along the way to ask the ratepayers in BC if that is a good idea and at what cost. The most recent forecast is no different than what Mr. Froschauer critiqued.

Demand for electricity in BC is from three categories: residential, business and large industrial. According to BC Hydro’s forecasting manager, the first two categories are driven by population and economic forecasts obtained from provincial sources. It is the third category where the trouble arises, much as described above. BC Hydro’s corporate development officer, Warren Bell, is tasked with taking expressions of need from would be new customers. He has demand growth for this group increasing from 15,722 GWhrs in 2010 to 22,271 GWhrs by 2017. In this group would be the Northern Gateway Pipeline, which has yet to clear environmental hurdles and get the support of the Provincial Government. Mr. Bell is tasking the corporation to be ready to provide electricity to what history tells us are the most fickle people BC Hydro could want as customers.

So does an unblemished record of demand exaggeration and an explosion in new investing/borrowing bring one closer to understanding why? I doubt it. So what else is there?

The answer may be found in another location. Most readers will not have heard or read of a private US corporation, the “North American Electric Reliability Corporation” (NERC). This private enterprise came into existence in 2006 and has the stated intent:

a. to promote the reliable planning and operation of the electric bulk power systems of North America;

b. to act as the electric reliability organization for the United States as certified by the Federal Energy Regulatory Commission and for Canada and Mexico as recognized by applicable government and regulatory authorities in such countries, all pursuant to law;

c. to develop, implement, and enforce, consistent with executed agreements with regional entities and approvals by applicable regulatory authorities, standards that provide for reliable planning and operation of the electric bulk power systems of North America; and

d. to conduct such other lawful business and activities, not otherwise inconsistent with specific purposes set forth herein, in which a corporation subject to the New Jersey Nonprofit Corporation Act may engage.

Since 2006 our Federal Government has caused the National Energy Board to complete a memorandum of understanding with NERC. In its 2010 Annual Report NERC states that its “standards are mandatory and enforceable in Ontario and New Brunswick as a matter of Provincial law. NERC has an agreement with Manitoba Hydro, making reliability standards mandatory for that entity.” MOUs also existed with Nova Scotia, Quebec, Saskatchewan and Alberta. Learn about the nature of BC Hydro’s obligations to NERC in this report.

So what has been taking place is the rearrangement of control of bulk electricity production in North America by a private US entity. NERC has the power to enforce its will on producers and looks to have the legal authority to by-pass local utility commissions. It is this development that might be the key to the understanding of why BC Hydro has indulged in its aggressive contracting with Independent Power Producers in BC when domestic demand increases are non-existant.