Following an eventful couple of weeks for the Canada-China energy trade file, Stephen Harper finds himself in quite a pickle. The Prime Minster is stuck between his resolute commitment to opening up a carbon corridor to Asian markets and the increasingly politically untenable position of supporting wholesale Chinese state ownership of strategic Canadian resources.

In addition to Harper’s mounting challenges over the proposed $15 Billion buyout of Canadian oil and gas firm Nexen by Chinese state-owned CNOOC, several prominent Canadian voices – including Federal Green Party Leader Elizabeth May and Council of Canadians founder and world-renowned trade expert Maude Barlow – have piped up about a controversial trade deal quietly signed by Prime Minister Stephen Harper last month, which they say would give unprecedented rights to Chinese corporations over Canadian resources.

As the tide of opposition to the Nexen deal continues to rise, Harper was forced to acknowledge this week, “This particular transaction raises a range of difficult policy questions, difficult and forward-looking issues.”

That’s putting it mildly.

The Nexen deal is problematic for the Conservatives for three main reasons:

- Public opinion is squarely against it, with some 70% of Canadians opposing it and four in ten viewing China as a threat, according to National Post columnist John Ivison (who nevertheless urges Harper to approve the deal as it’s in Canada’s best long-term interests)

- The Official Opposition has finally come out against the deal this week and appears poised to make political hay with its position.

- Most importantly, by far, powerful American political forces are lining up against the deal – charging that allowing these resources to flow to China constitutes a national security threat (our own CSIS concurs).

On that last point, Congressman Ed Markey, the ranking Democrat on the House Committee of Natural Resources, wrote to US Treasury Secretary Tim Geithner in July, imploring his office to block the deal (someone needs to inform the congressman that this deal doesn’t technically fall under Geithner’s jurisdiction, but it’s nevertheless a noteworthy and influential objection). Wrote Markey, “Giving valuable American resources away to wealthy multinational corporations is wasteful but giving valuable American resources away to a foreign government is far worse.”

Apparently even the Americans – whose resources these are not – recognize the danger in handing them over to the Chinese!

Meanwhile, with the NDP continuing to nip at the Conservatives’ heels, Harper might do well to ignore the advice of John Ivison and consider the short and long-term implications of accepting such an unpopular deal. Heck, even some of Harper’s own MPs oppose it!

NDP Energy and Natural Resources Critic Peter Julian laid out his party’s opposition to the deal at a press conference Thursday, as reported by the Globe and Mail:

New Democrats “cannot support the rubber-stamping of the CNOOC takeover of Nexen,” Mr. Julian said. “We cannot see the net benefit when we look at a variety of concerns and criteria that have been raised by the Canadian public.” Those concerns, he said, included the environmental and human-rights record of CNOOC, the potential for job losses and the risk of decision-making gravitating away from Nexen’s Calgary head office, plus risks to national security.

It is this “net benefit” test, under the Investment Canada Act, that is at the core of the decision Harper faces – which is expected by October 12, but can and may well be delayed by another month. The NDP has expressed doubt that the Harper Government will conduct this “net benefit” test in a transparent enough manner to reassure Canadians.

According to the party’s industry critic Helene LeBlanc, “By studying this transaction behind closed doors and not specifying what criteria they used to determine what represents a net benefit for the country, the Conservatives have given us no choice. When in doubt, it’s best to back off.”

Conservative Industry Minister Christian Paradis called the NDP’s position “reckless and irresponsible” in a news release.

Meanwhile, Harper’s quiet trade deal with China has drawn heated rebuke the past several weeks, as the two issues inevitably dovetail into each other.

A statement from the Council of Canadians last week noted:

A bilateral investment treaty between Canada and China, which was signed earlier this month and made public by the Harper government yesterday, will put unacceptable constraints on Canadian energy and environmental policy…The organization is once again calling on MPs to reject the Canada-China Foreign Investment Promotion and Protection Agreement (FIPA), and to stop signing what are essentially corporate rights pacts inside standalone treaties and Canada’s broader free trade agreements.

The organization’s National Chairperson, Maude Barlow, drew together FIPA and the Nexen deal, stating, “Canadians need to know that as Harper considers selling off Canadian energy firms to foreign investors in China and elsewhere, he’s also signing investment pacts that let these firms sue the federal government when delays or environmental protection measures interfere with profits.”

Council of Canadians’ Trade Campaigner Stewart Trew suggested these deals do little to promote investment, as is their stated mandate. “They are very useful, on the other hand, for extorting governments when things don’t go their way. That could be delays or cancellations to energy and mining projects, environmental policies that eat into profits, even financial rules designed to create stability or avoid crises can be challenged.”

Green Party of Canada Leader Elizabeth May shared many of these concerns with the House of Commons this week, calling for an emergency debate on FIPA, suggesting it bears “grave and sweeping implications for Canada’s sovereignty, security, and democracy.”

In a statement on her website this week, May said, “I pointed out in my notice to the Speaker that this is perhaps the most significant trade agreement since NAFTA, and the fact that it can be negotiated and ratified behind closed doors is very corrosive to our democracy.”

“I also realize that an emergency debate is far from sufficient under the circumstances, but it might be the only opportunity Parliamentarians have to review and discuss FIPA before we are bound to it for the next 15 years, especially if neither the NDP nor the Liberals focus on it during their Opposition Days.”

Whether FIPA receives its due attention politically – let alone gets cancelled – remains to seen, but the more it becomes connected to the clearly unpopular Nexen deal in the coming weeks, the more scrutiny it will face.

The exploding national debate around theses issues puts Harper in a tough spot. On the one hand, the Prime Minister has been very clear about his policy vision for the country – and expanding energy trade to Asia has been the centre plank in this platform, underscored by a visit to China earlier this year, during which energy issues were the main topic of discussion. He has made public and private commitments to Asian trading partners and to the Canadian oil patch.

Moreover, with US leaders promising to become far more self-sufficient in oil and gas resources over the next decade by massively boosting domestic production, there is increasing pressure on Canada to develop new export markets for its fossil fuels.

And yet, as prospects for the proposed Enbridge pipeline continue to wane and opposition mounts to Nexen and this new trade deal, the Prime Minster is gambling his political future on an increasingly unpopular strategy – whether he believes it’s in the country’s best interests or not. Add to that the concerns raised by CSIS last month about threats to Canada’s national security from such deals and you have a recipe for real political problems if the PM continues down this path.

As University of Ottawa Law Professor Penny Collenette put it in the Globe and Mail’s story yesterday, with the NDP jumping on the issue, “Now it is burst wide open onto the political scene,” and becoming “a kitchen table national debate.”

That’s the last thing Stephen Harper’s energy plan needs right now.

government justifies with the contention it is needed to provide power to gas and mining operations.

government justifies with the contention it is needed to provide power to gas and mining operations.

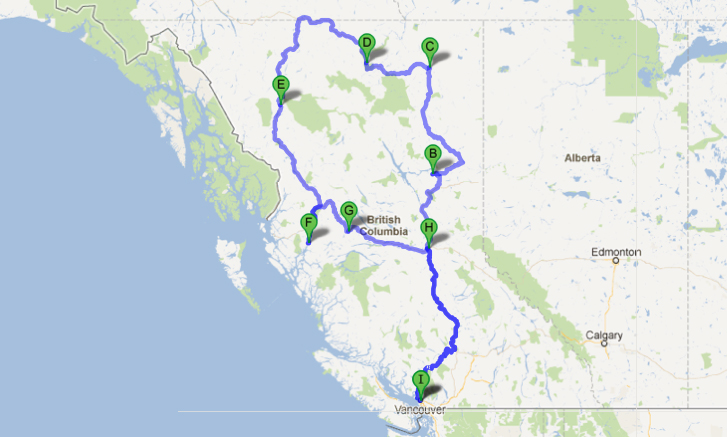

deliver a presentation to faculty and students at UNBC, before heading home to Vancouver (an approximately 5,000 km journey, all told).

deliver a presentation to faculty and students at UNBC, before heading home to Vancouver (an approximately 5,000 km journey, all told).  an market with supply, driving down the price for gas, which is why new markets are being sought in Asia, where gas prices are currently much higher.

an market with supply, driving down the price for gas, which is why new markets are being sought in Asia, where gas prices are currently much higher.