I cannot believe it! Liberal leadership candidate Mike de Jong talks about the Toba Inlet Independent Power Project (IPP) as not a truly private project because Plutonic (General Electric in drag) has partnered with the local First Nation! This, says Mike, makes it a “community” project. This is an interesting point of view considering that Don McInnes, head of Plutonic, told a legislative committee in 2004 that private power companies shouldn’t have to share any profits – not even 1%! – with First Nations. I won’t dwell on this point because it’s irrelevant to the main question – namely, are IPPs a good idea? Mr. de Jong would be a premier who would encourage more and more IPPs even though he obviously doesn’t have the faintest idea as to what they’re all about.

For example, de Jong, to Bill Good, made the nonsensical claim that these projects don’t divert much water, compared to a conventional dam – which is backwards. These IPPs are diversion projects; whereas dams hold back water, but don’t usually divert it. The Toba projects divert, in fact, something on the order of 90% of the mean annual flow of the rivers for miles.

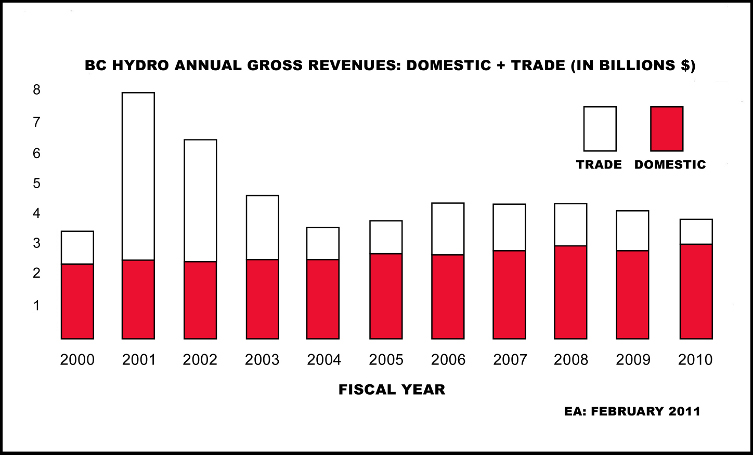

It’s hard for me, a former cabinet minister, to understand the utter ignorance of the present Liberal bunch have towards IPPs. That a possible premier of BC doesn’t understand that these environmental disasters are making the energy when BC Hydro doesn’t need it yet must buy it anyway; that when they do they must export it at a huge loss or use it themselves, paying 12x what they can make it for themselves, takes the breath away.

This is, however, not an uncommon syndrome affecting politicians called (forgive the technical term) believing your own bullshit. If those seeking the premiership don’t understand the pickle they’ve got us into, God help us.

In fact there’s no evidence that any of them have the faintest idea of what’s involved here.

This is a dramatic turnaround for it was always the NDP whose policy was wrapped up in a one-liner: now the Liberals have no idea of what IPPs arel about and use idiotic statements like “BC needs IPP power to become self sufficient”, whereas the opposite is the case.

BC Hydro’s recent statement of its needs takes the breath away.

Here’s what economist Erik Andersen comments – in summary:

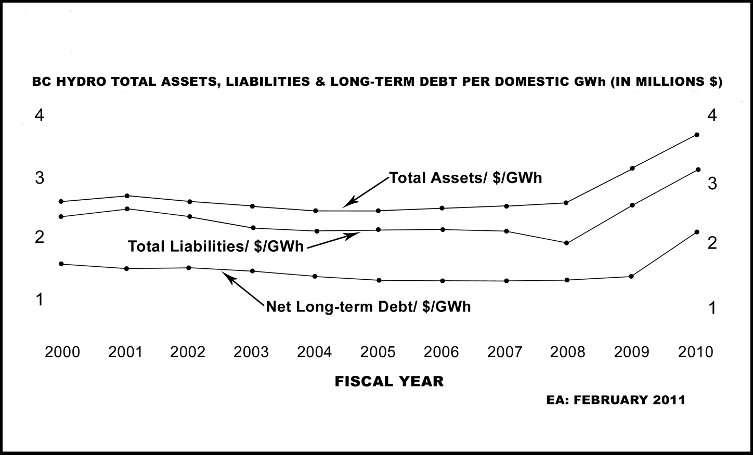

- Hydro’s financial statements show that its total liabilities have increased by more than 40% at least in the last 3 years

- As things look from their statements, BC Hydro may be bankrupt by this summer. Of course, it won’t officially go into bankruptcy, as a company in the private sector would under these circumstances, but it does mean that what little independence they have will be gone.

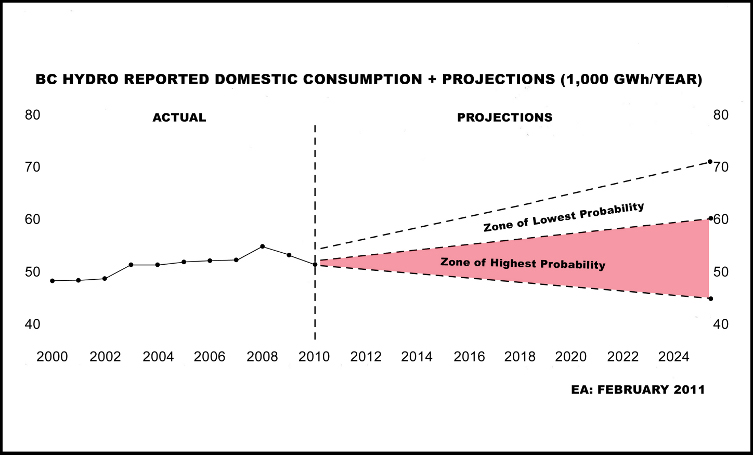

- Mr. Andersen observes that BC Hydro was forced to buy 8,300 GWH under the Hobson’s choice they face of either exporting the unwanted IPP power at a huge loss or using it instead of their own power at 12x what they can make it for themselves.

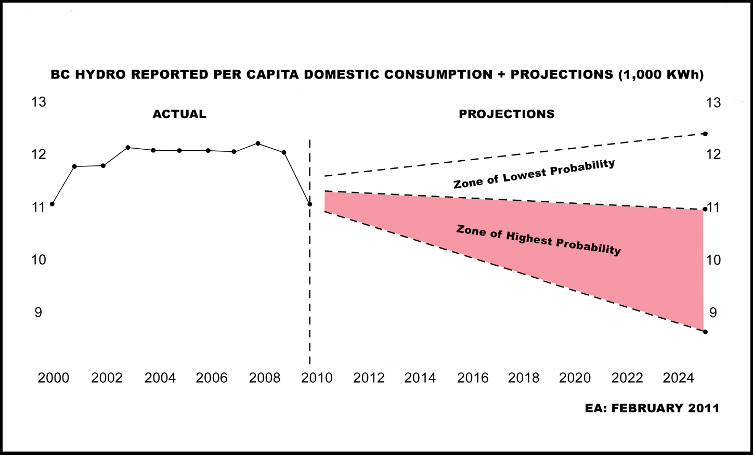

- BC Hydro has always overestimated its needs – Mr Andersen says, “I’m expecting the annual per capita demand by BC only customers to drop from about 11,000 KWh to about 9,000 by 2015. One should note that Mr Andersen’s experience in such matters was learned by preparing demand outlooks for Government of Canada Treasury Board applications in support of new capital projects.

- Mr Andersen concludes that a recent announcement by BC Hydro that it will seek to raise consumers’ power bills by 50% over the next 5 years “is about deflecting uncomfortable observations and providing a cover for more aggressive borrowing now in the works”.

Speaking of uncomfortable observations, nowhere in this announcement did Hydro tell us how it’s going to pay the ungodly sums (now estimated at $50+ Billion) to be paid out to IPPs for power it doesn’t need. This scarcely chump change! This is huge – a million dollars times 50 thousand! It will increase as new cozy deals are made by the Liberal government’s favourite campaign donors.

Where the hell is this money to come from?

How can Hydro go to the BC Utilities Commission for enormous rate increases without telling anyone how they’re going to raise this unimaginable money going to the likes of General Electric – no wonder it’s the biggest corporation in the world!

These matters have not occurred, evidently, to those who want to be premier. It has, one might note, occurred to two NDP wannabe premiers John Horgan and Mike Farnworth who, casting aside traditional NDP slogans, have presented platforms that indicate their understanding and solutions to the problems.

This government has got the taxpayers in very deep doo doo indeed and finding the way out will be a challenge for all our citizens.

The sad part is that the Liberal leaders don’t even acknowledge that there’s a problem, much less offer solutions.