This article is republished with permission from Watershed Sentinel.

In a move that could cost him significant political support, federal NDP leader Thomas Mulcair has endorsed controversial west-to-east pipeline proposals that would move tar sands crude from Alberta through Ontario and Quebec to Atlantic Canada and points beyond.

During a Sept. 28, 2012 speech to the Canadian Club of Toronto, Mulcair said, “Let me be clear, New Democrats support recent proposals to increase West-East pipeline capacity. This is an initiative, led by industry, that will pay economic dividends for every region of our country: new markets for [tar sands] producers in the West, high-paying value-added jobs and lower energy prices in the East.”

Mulcair called this a “pro-business common sense solution.”

With a bottleneck of crude at the storage hub in Cushing, Oklahoma, pricing discounts for diluted bitumen (dilbit) at US Midwest refineries, and strong opposition to tar sands export pipelines in both BC and the US, the industry has seized upon “eastern access” to Atlantic tidewater as a solution. Canada’s top two pipeline/utilities companies – Enbridge and TransCanada Corp. – are each developing plans to pipe crude east, while environmental groups across Ontario, Quebec and New England have been gearing up for a major fight on the issue.

The “Wrong Product”

Ironically, only hours before Mulcair’s speech, Alberta Federation of Labour president Gil McGowan issued a press release (Sept. 27) stating: “The bottom line is Alberta is selling the wrong product [dilbit]. The glut of bitumen on the market is a result of bitumen looking for appropriate refineries. If the product was SCO [synthetic crude oil], we could be selling the product to any refinery in North America.” As well, many pipeline safety issues could be avoided (see March-April 2012 Watershed Sentinel).

Tar sands producers generally produce either “synthetic crude,” which has passed through an on-site upgrader, or dilbit, which is raw bitumen thinned with lighter petroleum products and proprietary chemicals. With increased production over the last few years, tar sands producers (which are mostly foreign-owned) are now piping out more dilbit in order to cut their costs. According to Alberta Energy, there are only five operating upgraders in Alberta, and in 2011, “about 57% of oil sands production was sent for upgrading to synthetic crude oil within Alberta,” a percentage that will rapidly decline as production vastly increases. Over the next decade, tar sands producers reportedly plan to triple the amount of dilbit they pipe.

On July 23, 2012, the US National Academy of Sciences began hearing expert briefings on whether dilbit increases the risk of pipeline spills, as environmentalists claim. Gil McGowan’s point is a crucial one: not all refineries in North America can handle dilbit, nor can all refineries in eastern Canada. That fact is significant to understanding who would benefit from “eastern access” pipelines plans.

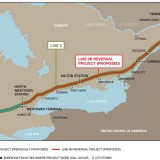

Line 9 Reversal

Enbridge is now moving quickly on a plan to pipe tar sands crude through Ontario, Quebec, and New England to Atlantic tidewater in Portland, Maine. From there it would be shipped by tankers to refineries in the US and elsewhere.

In May 2012, Enbridge announced a $3.2 billion expansion of its North American pipeline system, including expansion of its Lakehead system which pipes dilbit from Alberta to US Midwest refiners. Some of that dilbit also reaches refineries in Sarnia, Ont., via Enbridge’s Line 5 (which brings dilbit from Superior, Wisconsin, across northern Michigan to Sarnia), and Line 6B (which pipes dilbit from Chicago across Michigan to Sarnia). Both Line 5 and Line 6B extend from the tar sands across Alberta, Saskatchewan and Manitoba before entering the US at Superior, Wisc. According to rabble.ca (Sept. 11, 2012), in Sarnia “tar sands are already being refined [by Imperial Oil and Suncor] at an estimated rate of 225,000 barrels per day.”

It was Enbridge’s Line 6B that ruptured in Michigan in 2010, spilling 20,000 barrels of dilbit into the Kalamazoo River. During repairs, Enbridge has quietly been increasing the capacity of that pipeline to 500,000 barrels per day (bpd).

Enbridge also intends to reverse Line 9, which currently carries 240,000 barrels per day of imported conventional oil from Montreal to Sarnia. On July 27, Canada’s National Energy Board granted approval for the reversal of a portion (9A) of Line 9 between Sarnia and Westover, Ont. (where an oil hub is located that diverts crude to Imperial Oil’s refinery in Nanticoke, Ont. and to Pennsylvania refineries).

Enbridge intends to file for the reversal of the remaining portion (9B) between Westover and Montreal this autumn. On Oct. 23, Enbridge filed a document with the NEB showing it plans to increase the capacity of Line 9 to 300,000 bpd and switch it to carrying “heavy crude,” which includes tar sands oil.

In order for tar sands crude to reach the Atlantic, another pipeline – the Portland/Montreal Pipe Line (PMPL – which brings imported conventional oil from Portland, Maine to Montreal) – would also have to be reversed. The PMPL passes through Quebec, Vermont, New Hampshire, and Maine.

The Portland/Montreal pipe is majority-owned by Imperial Oil and Suncor. Officials with PMPL have reportedly been in talks for over a year to reverse that line.

Enbridge also intends to export tar sands crude from Portland, Maine. According to the Globe and Mail (June 1, 2012), “In a recent conversation with Streetwise, Stephen Wuori, Enbridge’s president of liquids pipelines, said his company believes it can export crude from the US without consequence. Asked if it would be possible to send oil to international markets from Maine, he said the answer is yes.”

More recently, the Globe and Mail reported (Sept. 6, 2012) that Enbridge “has met with officials from refineries in Quebec City and Saint John to discuss their appetite for Western Canadian crude. Companies could barge oil from Montreal to Quebec City, and then perhaps ship it by rail to Saint John.”

TransCanada’s Mainline to the East Coast

TransCanada Corp.’s natural gas Mainline runs 14,000 kilometres from the Alberta/Saskatchewan border to where Quebec meets Vermont. The Mainline, which pipes natural gas to Ontario, has been operating at only half-capacity in recent months because of competition from US shale gas. Canadian Natural Resources Ltd. and others have been urging the company to switch to carrying crude in its gas Mainline. TransCanada Corp. is also one of the owners of Ontario nuclear power-generator Bruce Power, which has been pushing the nuclear option for tar sands/energy production in Alberta and Saskatchewan.

TransCanada Corp. has not disclosed much about its west-to-east pipeline project, but recently Globe & Mail reporters Nathan Vanderklippe and Shawn McCarthy provided (Sept. 6, 2012) some details on “a massive $5.6 billion new pipeline system that would carry large volumes of western crude to refineries in Ontario, Quebec, and beyond.”

Their news report states:

The East Coast project described to [us] by industry sources would involve converting roughly 3,000 kilometres of underused natural gas pipe – the Mainline is made up of a series of parallel pipes – into oil service. It would also involve building at least 375 kilometres of new pipe from Hardisty, the Alberta oil hub, to the Mainline at Burstall, Sask., and from near Cornwall [Ont.], at the other end, to Montreal. Another 220 kilometres would be required to reach Quebec City. Oil could be loaded onto ocean-going vessels either on the St. Lawrence River, or destined for American refiners via Portland, Maine, through a pipeline [PMPL] to Montreal whose flow could be reversed…The TransCanada proposal would send 625,000 barrels a day across the country to Montreal, Quebec City and potentially Saint John, NB, where Irving Oil Ltd. runs a large refinery. Tanker exports could then also take the crude to Europe or Asia.

In late July 2012, RBC Capital Markets urged that TransCanada Corp. stop focusing on the controversial Keystone XL pipeline to Texas and instead convert its Mainline to carry 900,000 barrels per day of tar sands crude to Sarnia, and then use Enbridge’s Line 9 to move it to Montreal.

So potentially, more than 1.4 million barrels per day of tar sands crude could be piped through southern Ontario and Quebec – the most populated area of Canada – to points east. The industry considers “eastern access” pipelines to be in addition to projects like Northern Gateway.

Upstream/Downstream

Refining is currently considered a financially viable business in North America mainly for companies that both produce (“upstream”) and refine (“downstream”), largely because they can buy dilbit and other feedstock cheaply and then sell the refined petroleum products for a high price internationally.

In the tar sands, companies with both upstream/downstream facilities in North America include Imperial Oil, Suncor, Shell, Husky, Valero, Marathon, ConocoPhillips, Cenovus, BP, and Flint Hills Resources/Koch Industries. Many of these companies have already invested billions to convert their refineries in the US Midwest and Gulf Coast for processing tar sands crude.

In 2010, Royal Dutch Shell closed its Montreal refinery and converted it into a fuel storage terminal. Imperial Oil put its Dartmouth, NS refinery up for sale on May 17, 2012, but is also considering converting it into a storage terminal. By the terms of its sale to Korea National Oil Corp., the North American Refinery in Newfoundland only refines the province’s offshore oil, with most of its refined petroleum products exported to the US. As of March 2012, Shell is considering upgrading bitumen at its Ontario refinery and Suncor is considering the same thing for its Montreal refinery. The resulting “synthetic crude oil” would still have to go to another refinery to be made into products like gasoline, diesel, and jet fuel.

Peter Boag, president of the Canadian Petroleum Producers Institute – which represents the refining and marketing sector – told the Globe and Mail (Sept. 6, 2012), “Significant changes to the crude diet to really ramp up the volumes of western-based heavier crudes in Eastern Canada is going to require some significant investment in refinery reconfiguration.” As Gil McGowan put it, Alberta is selling “the wrong product.”

The Irving Empire

According to the University of Calgary’s Jack Mintz (Financial Post, Dec. 16, 2011), the only refinery on the Atlantic that can currently process “heavy sour diluted bitumen [dilbit]” is “the Irving Refinery” in New Brunswick. Otherwise, he said, “this type of crude cannot be processed in eastern North America.”

Enbridge has been planning its “eastern access” pipeline since at least 2008. On March 11, 2008, Reuters reported that “Enbridge Inc. is looking at moving oil sands crude to the US Northeast and Eastern Canada,” and quoted Enbridge CEO Patrick Daniel: “If we move to reverse Line 9 [in Ontario], that could come before [Northern] Gateway [in BC]. If it is a large volume, 400,000 barrels a day, [Northern] Gateway would come first.”

In 2011, Enbridge appointed to its board a director of Irving Oil, which now owns 50 per cent of an oil terminal in Portland, Maine.

The Globe and Mail reported (Aug. 23, 2012) that Irving Oil “unveiled a proposal three years ago to build [another] 300,000 barrels-a-day [refinery] facility to serve the northeast United States,” and later partnered with BP on the idea – which is currently shelved. According to the same newspaper (Sept. 6, 2012), the Irving Refinery in Saint John buys about $10 billion per year of imported conventional oil, refines it, and then sends “eighty per cent of the plant’s production” south of the border.

Obviously, tar sands producers like Canadian Natural Resources Ltd. – which owns no downstream refineries – are eyeing that annual $10 billion in hopes that it will be used to buy crude piped east. Canadian Natural Resources Ltd. plans to greatly increase its tar sands production to one million barrels per day over the next decade. Frank McKenna – the former premier of New Brunswick and a current director of Canadian Natural Resources Ltd. – has been one of the most vocal proponents of west-to-east pipelines from Alberta, and has called for a new oil pipeline from Montreal to Saint John.

In mid-July, Canada’s Parliamentary Standing Senate Committee on Energy, the Environment and Natural Resources (with 7 Conservative and 5 Liberal members) endorsed west-to-east tar sands pipelines as a “nation-building” project.

Besides Frank McKenna and the Senate Committee, other outspoken proponents include Derek Burney (a director of TransCanada Pipelines Ltd.), Eddie Goldenberg (a lawyer with Calgary law firm Bennett Jones), the “ethical oil” people, and now the NDP’s Thomas Mulcair. Some commentators consider the west-to-east pipeline plans to be the centre of Alberta Premier Alison Redford’s “national energy strategy.”

But the plans by Enbridge and TransCanada Corp. seem largely to be a strategy for Big Oil to get a higher price for dilbit by export via the Atlantic – most likely to the US Gulf Coast, where their downstream profits would be highest.

Environmental organizations across Quebec, Ontario, and New England, along with some First Nations and landowner organizations residing along Line 9, have been rallying in opposition to these west-to-east pipeline plans.

All this is happening mainly because the Alberta government is too timid and subservient to require that all tar sands production be upgraded or refined on-site. Instead, it keeps allowing Big Oil to pipe out more and more of “the wrong product.” As a result, tar sands pipelines will continue to be fought across North America.

***

Joyce Nelson is an award-winning freelance writer/researcher and the author of five books.