By Norman Farrell

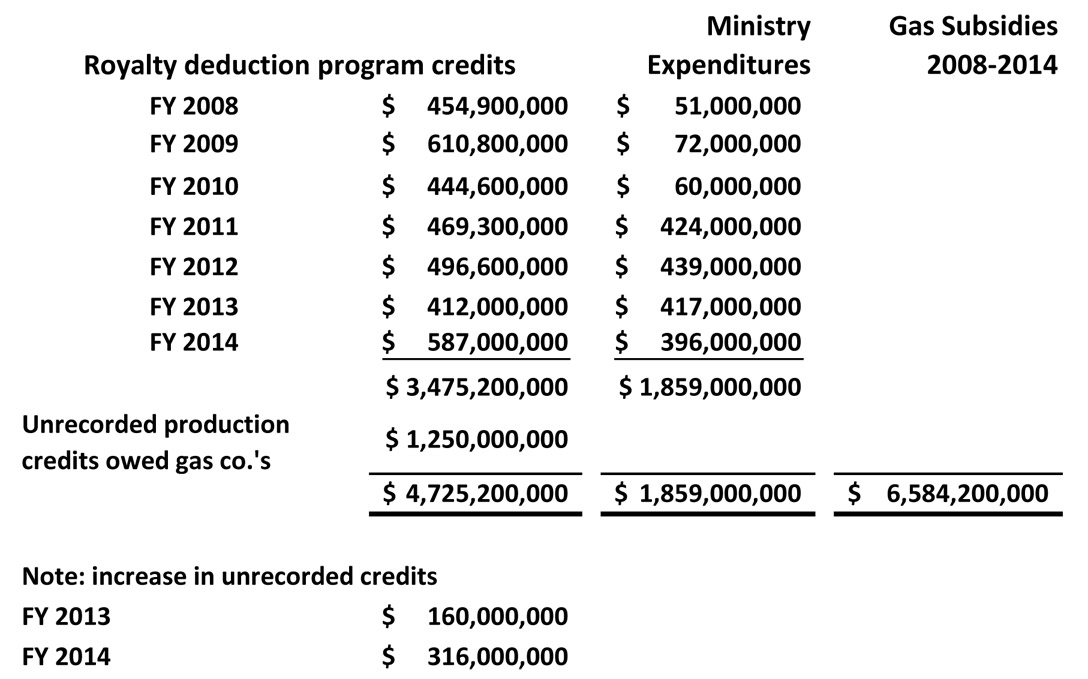

Regular readers are aware that British Columbia’s natural gas industry provides surprisingly little return to the province by way of royalties for depleting non-renewable public assets. In the last two fiscal years, after accounting for drilling and road subsidies taken by or owed to producers, the province’s net gas royalty receipts averaged $2.5 million a month. That is less than 1/10 of 1% of BC government revenues.

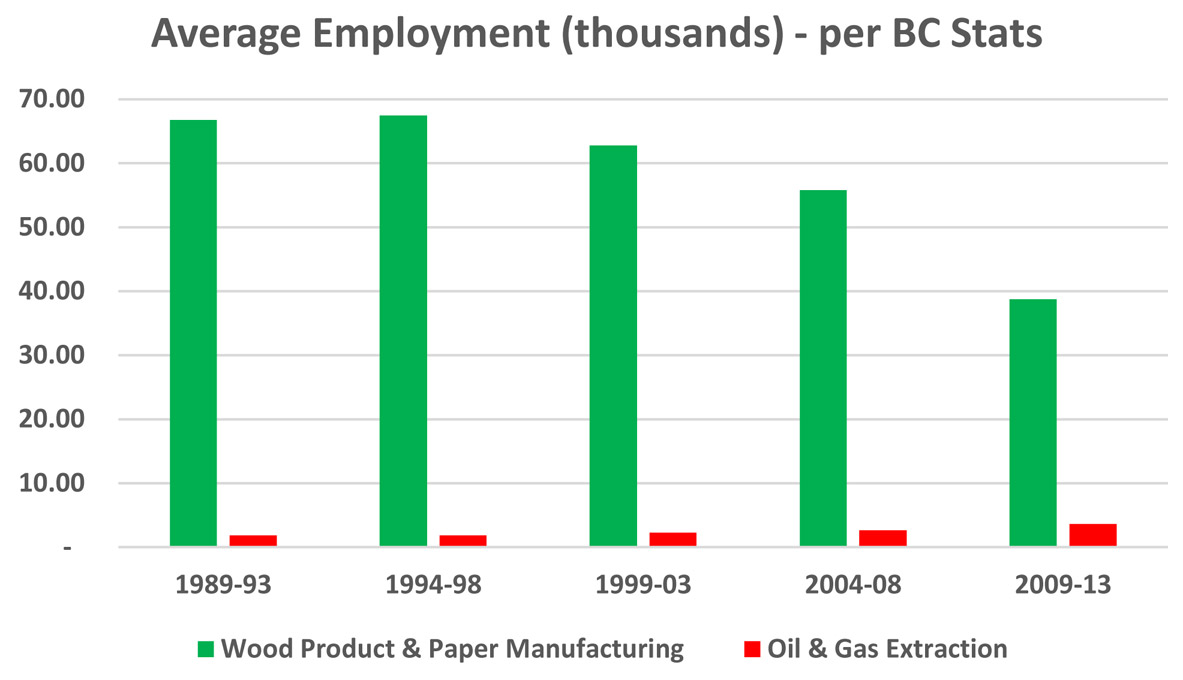

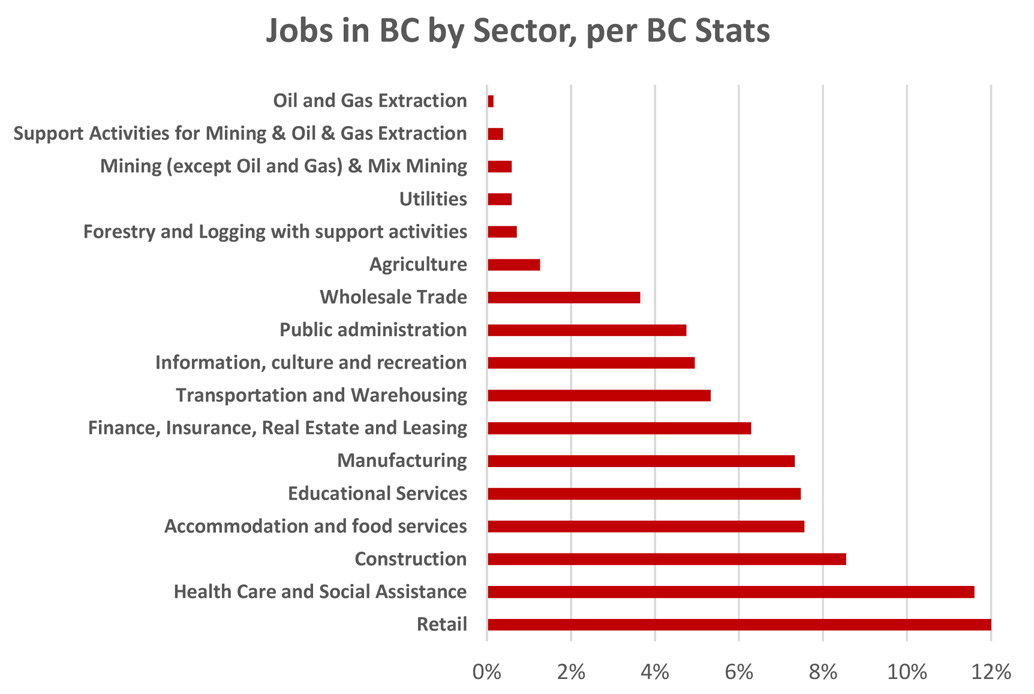

Defenders of government policy suggest the industry is contributing much economic value to BC through jobs. Yet, government statistics show that only about 3,000 people are directly employed in oil and gas extraction. Education and manufacturing each provide more than 50 times as many jobs. Retailing, almost 100 times as many.

In 2013, Christy Clark’s government resisted calls from the motion picture and sound recording industry for subsidy increases, yet this non-polluting, non-depleting industry provides four times as many jobs as oil and gas extraction. It stimulates cultural and tourism activities and costs a fraction of the subsidies flowing to oil and gas production.

As Premier, Clark pays little attention to forestry, the traditional engine of our economy. The only part of the industry that remains busy is logging, a function that cannot be moved out of province.

So questions arise. What influences a government to offer special treatment to one particular economic sector that provides scant economic return and relatively little employment?

Who and where are the real beneficiaries? In what jurisdiction, if any, is corporate income tax paid on profits of gas production and sales?

Were decisions to provide public funds and public assets fairly determined or were they improperly influenced by the flow of cash from industry to the holders of political power?

I think the answers are self-evident. British Columbia is governed by captives of industry.

NOTE: The chart below illustrates some of the hidden costs to BC taxpayers of subsidizing the natural gas industry. Feeling that they overpaid for leases that are yielding few profits with fallen gas prices, the industry has been granted a series of royalty deductions, now totalling some $5 Billion. Factoring in other ministry expenditures to the benefit of the industry, the natural gas sector has actually received $6.5-7 Billion in taxpayer subsidies since 2008.

Norman Farrell is a BC-based political blogger and publisher of Northern Insights

This is one of the scariest articles I have read in a long time along with the Tyee article telling us that in North America there are huge losses in the oil and gas industries. We can subsidize 3000 employees to over a billion dollars a year and bring in $2.5 million per month in royalties. The provincial taxes paid by the 40,000 teachers is more than that. There is clearly no logical reason to be pushing oil,gas and coal when you have to subsidize to this extent. Lets subsidize solar, wind, geothermal, heat pumps. If every body that lived in moderate BC switched to a Heat Pump the amount of gas saved would be phenomenal. Why not hire back all the Park Rangers, Conservation Officers, Forestry and Mine Workers.Why not reforest the Pine Beetle devastated forests (but this time don’t replant the same specie and pray they won’t be attacked) The multiplier effect from their salaries would be far more beneficial to the economy.

Your comment carries way too much common sense – the government won’t hear of it.

One must remember that most public figures must undergo a “lobotomy” to get their positions. This renders them unfit for regular employment and ideal material for the likes of the BC Liberal government.

Sorry, I could not resist making fun of how “stupid” the BC provincial government has become – literally.

Thanks

This article looks at a tiny portion of the revenue the province gets from the oil and gas industry. The industry leases land from BC, at its lowest in 2011 it was 114 million, at its high in 2008 it was 2.6 billion with a B.

Additionaly this industry is the main source of income for Dawson creek, Fort St John, Fort Nelson and Chetwynd. Supporting at least 100,000 people. a very large part of the industry are support workers, if you shut in the industry in BC you would loose at least 30,000 jobs and how would you heat your house? It would also cost the government at least 500 million a year in land fees, and royalties plus another 400 million in lost taxes from employees.

Thats great that a billion dollar subsidy employs those people. But don’t tell the people of BC that LNG and Natural Gas is going to make this province rich when in reality it costs the province money. What are the long term costs of the industry and especially the long term costs of fracking. Maybe the money could be used better to subsidize reforestation of the pine beetle forest. From what I can tell this whole tracking is a big ponzu scheme where the real money is made on flipping the properties not the actual drilling. But it is time the people of North America realize the true costs and subsidization of fossil fuels.

According to StatCan and BC Stats reports, oil and gas extraction averaged 3,000 full time jobs since 2007, which is 0.1% of all jobs in the province. The same sources report an average of 8,700 jobs in support activities for mining & oil & gas extraction – about 1/5 of those involving gas.

Land leases and drilling permits, which are separate from royalties, have ceased to generate major revenue. In the 3 months ended August 31, 2014, government received only $16 million.

There is no suggestion the industry should be shut in. What could be suggested is that operations be closely monitored and regulated and that natural gas producers pay a fair share for the public resources they deplete. If they took no subsidies from government, they would be on the same footing as most private businesses in BC.

The weight of science that is independent of fossil fuel industries, declares that increases in gas production involves previously unrecognized environmental dangers. The latest, from the National Academy of Sciences, is discussed in the linked article below.

When regulators don’t believe in regulation

In my description of costs to BC taxpayers, no value is assigned to environmental degradation and that amount could be huge. So we’re not merely foregoing royalties and depleting gas stocks, we’re damaging vital interests of future generations. This is made worse by the lack of regulations and inspections.

Additionally, construction of Site C, which could easily cost $15 billion will destroy large amounts of current and potential farmlands. One factor in proceeding with this project is the BC Liberal desire to offer cheap power and water to the gas industry. The returns BC gets from this industry is simply not worth the costs involved.