Almost four years ago I prepared an article on the financial affairs of BC, musing about the way BC voters returned the BC Liberals to government. This time I am posting their record before a vote in hopes that there will be a different outcome.

It began with a quotation from “The Divine Comedy” by Dante Alighieri (otherwise known as Dante’s Inferno): “The Darkest Places in Hell are Reserved for those who maintain their Neutrality in Times of Moral Crisis.”

In that same piece, I warned:

[quote]The citizens of BC had a front row seat to an election outcome that remains almost impossible to comprehend. After a determined push-back of the much reviled HST it appeared very probable that the BC Liberal party would go down to a well-earned defeat. It would have been a defeat, not so much because a better option was thought to be on offer, but more because enough voters had lost their trust in those who seemed divorced from contemporary economic realities and who were not serving the public’s interest.[/quote]

Ahead of next month’s election, we seem to be in a similar place as four years ago. The BC Liberals have been shovelling out large amounts of propaganda, some paid for by using the taxpayer’s own money, that include “alternative facts” and an avoidance of mentioning other inconvenient truths. Fact one, as presented by the BC Auditor General, is the staggering amount, $101 billion, of “Contingencies and Contractual Obligations” posted a year past. These obligations come from BC Hydro’s commitments to buy power from private suppliers at far above market rates, and from other infrastructure built under public-private arrangements. As such, it is in addition to our conventional debt and hidden from public view. The Government carefully avoids all talk of this debt and of BC Hydro’s “regulatory assets” accounts, which stand at another $6 billion.

Within Canada, we in BC have the dishonour of having the largest total of this type of debt of all the provinces and about 75% of what is shown for the Government of Canada. Hands-down, BC wins the race to be the most indebted province in Canada (see page 40 in the Auditor General’s report dated Feb. 2017). This condition is not accidental.

Back in 2013, I also wrote:

[quote]Standard & Poor’s issued a public report dated 15 April, 2011 titled “Canadian Provinces Face Tough Choices in Restoring Fiscal Balance”. The report directed provinces to curb rising debt levels and to correct the practices of deficit budgeting. It also recommended operating expense savings to be found in the budgets for health care and education.

“Rising debt service burdens further limit financial flexibility because as these burdens increase as a share of total spending, they crowd out other program spending,” claimed the report. “Debt service expenditures are contractually bound and as such cannot be easily cut.” [emphasis added]

This was an unambiguous disclosure that provincial credit ratings were under negative scrutiny, over two years ago.[/quote]

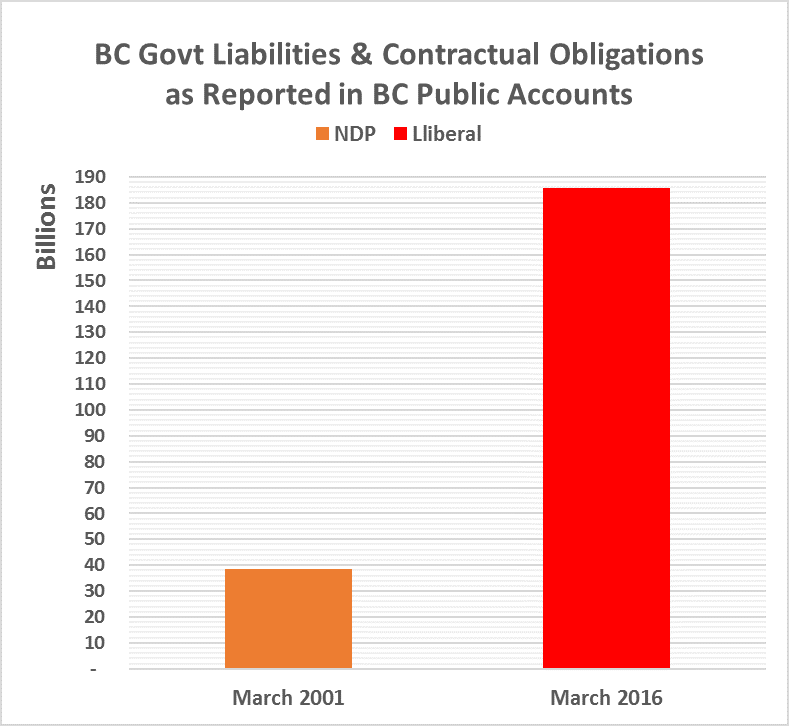

All those years ago, the credit rating agency gave the provinces the best of their advice so that credit downgrades could be avoided. The BC Liberal government certainly paid attention to the suggestion that education and health care budgets be trimmed but that’s where it ended. The chart below by Norm Farrell makes it blindingly clear that the BC Government failed to read or heed the recommendation to “curb rising debt levels”. Between when the S&P report was issued and last year, BC’s total financial liabilities increased from $117.8 billion to a staggering $185.7. That is a near +60%, exactly at the time the credit rating agency is suggesting a “go slow” on borrowing, either by direct means or by the indirect method of signing long-term contracts.

This S&P report is a one-dimensional view of financial affairs – only about spending and borrowing. There should always be an inclusion of the revenue side to deliver balance in such discussions. What the BC Government avoided talking about was government revenues and, my goodness, does it show. For the period 2011 through to 2016 the per person revenue barely increased from $9,228 to $9,844. Removing inflation, this was not a record of growth but the opposite and there is no new evidence that this will reverse.

On that note, eminent geologist and energy expert David Hughes has taken the trouble to examine the reported volume of BC natural gas production (almost totally for export) versus the royalties booked by BC. In 2005, BC’s production was about 2.8 billion cubic feet per day and natural gas royalties were about $2.1 billion per year. Fast forward to 2016 and the respective numbers were 5.2 billion cubic feet per day and $200 million per year. In David’s words, “Production has doubled since 2005 whereas revenue is down 87%”. If this is not a picture of giving away public resources I can’t imagine worse, unless maybe fresh water. If the public of BC are not benefiting from the extraction and sale of natural gas, then who is? This is the opposite to how the Norwegians do things. Perhaps we should hire folks from there to manage our natural gas industry.

Back to 2o13. Here’s what I said:

[quote]So what did the BC Government appear to do knowing this was like a warning shot across the bow? They did screw down on budgets for education and health care. They did not seriously attempt to find more revenues but rather promoted the fiction that the natural gas industry would provide fiscal salvation, which it did not nor is likely to happen despite election rhetoric. The government certainly did not curb its appetite for ever more debt.

At the end of fiscal 2012 (one year ago) total provincial liabilities reported by the Comptroller General were $70.358 billion or 100% greater than when the Liberal government first came into power. What was even more distressing was the government’s deliberate non-disclosure of “Contingencies and Contractual Obligations” the BC Auditor General publicly reported to be $96.374 billion. This liability amount was separate from the $70 billion, as confirmed directly with the Auditor General’s office. These provincial liability values were directly supplied to the four party leaders just following the writ being dropped, so they all knew, but for what ever their reasons, they remained silent. In a few words, BC voters were clueless about the province’s financial condition prior to voting, virtually all politicians and the mainstream media wanted to practice willful ignorance. It is not hard to understand why Premier Clark avoided this topic but why the others to do so is a big mystery.[/quote]

So what should be in BC’s future? The biggest standout is the rapid increase of provincial liabilities. A credit downgrade has to be a high probability and that will make everyone’s cost of living in BC higher. Suspending projects like Site C would possibly defer any credit downgrade. Carrying on spending and borrowing as before will only make the possibility of the downgrade greater. The second biggest issue is the deliberate reduction in revenues from the extraction of natural resources. If there is no “pricing room” for higher royalties, the solution is not to give away real assets for the sake of a handful of jobs but rather to wait for the next cycle to develop.

this is a really excellent article Erik, but the numbers for BC are really depressing. I would like to circulate this as much as possible.

i don’t doubt your numbers but can you just provide some clarification on where the $185 Billion total comes from?

I see there is $101 Billion in Contingent Liabilities, etc. plus the $65 Billion for actual Debts, for a sub-total of $166 Billion roughly, so there must be something else to get to a $185 total?

Hello David; You are rightly puzzled about debt and liabilities. Because the term “debt” has a very specific meaning which means what is counted excludes all contractual obligations I prefer the description “liabilities”.

The Auditor General only collects these financial obligations in a footnote to the province’s annual balance sheet. Because so much of the recent public and private works come with public contractual guarantees all of these in the end up as financial obligations, directly and/or indirectly, of BC citizens.

In the case of the annual report by the Comptroller General, he shows provincial “debt” and some additional amounts as liabilities, getting his total to the $85 billion. You have to look carefully to find this number.

I asked the AG if there was double counting in the numbers by him/her and those by the CG. In writing, he confirmed there was no double counting.

I think it is important to understand the subtle the distinction between “debt” and “contractual liability”. Premier Campbell certainly did. By selecting contracting with a private party the Province does not have source financing. Macquarie was to be P3 partner for the Port Mann but had to back out of the financing role when it failed to raise adequate financing. Financings for the tunnel replacement, Transit projects and Site C dam will likely face the same resistance in the market place.

Hi Erik

Great article…can you please give me the reference to the David Hughes article regarding royalties for natural gas. Those numbers you cite are insane…I would love to see the source.

Thanks so much

Leah

Hi Leah; I will send you by separate and private e-mail a copy of David’s chart if you promise me that you will keep it private. David is to present this chart and others this summer at Banff so he ask me to only use his words and do an interpretation of his chart for the numbers I am using. It is important to him so it is important to me.

Cheers Erik

contact me at twolabradors@shaw.ca

“On that note, eminent geologist and energy expert David Hughes has taken the trouble to examine the reported volume of BC natural gas production (almost totally for export) versus the royalties booked by BC. In 2005, BC’s production was about 2.8 billion cubic feet per day and natural gas royalties were about $2.1 billion per year. Fast forward to 2016 and the respective numbers were 5.2 billion cubic feet per day and $200 million per year. In David’s words, “Production has doubled since 2005 whereas revenue is down 87%”.”

I assume this ($200 million) is before the royalty credits that Norm Farrell talks about?

https://in-sights.ca/2017/02/09/bc-government-hiding-2-bn-liability/

Hi Barry; I suspect Norm is reading these postings so I will leave it to him to give you the detail you are asking about.

I wasn’t so caught up in the detail simply because the enormity of the changes were so dramatic.

In true open markets there is only one side of a trade that takes prices lower and yes, it is the production side i.e. sellers. This was clearly shown in a recent post about the Hawian buyers bailing on their non-binding contract with Fortis Canada on the long-term purchase agreement covering LNG. I don’t know what it will take for the BC Liberals to accept that promoting natural gas production and LNG plants is simply pushing on a rope.

Why would you link to the Auditor General’s report without stating that she doesn’t believe that contractual obligations should be included as debt? That’s just shoddy writing…

From here:http://www.vancouversun.com/vaughn+palmer+debt+contractual+obligations+accumulated+surpluses+them/11771565/story.html

Should contractual obligations be added to the $63-billion provincial debt as critics have suggested? “No,” says the auditor general, distinguishing between obligations undertaken to pay for goods and services provided in the past and those that must be paid for in the future.

“Debt is the amount of money that government has borrowed, and which must be repaid, “writes Bellringer. “Debt has repayment terms. If government should fail to meet those terms, then the debt potentially becomes payable in full right away. This is the difference with contractual obligations, in that they must be paid, but not right away, only at fixed dates in the future as the service or goods are provided.”

Good day Mike; This kind of discussion over terminology is exactly the point being made by Michael Hudson. Playing fast and loose with terms is the Enron game. Premier Campbell grasped the difference between the formal term “debt” and what is debt in another disguise called “Contractual Obligations”.

Most adult citizens address the requirements for getting a loan or an increased credit line from their bank as a matter requiring full disclosure of all outstanding liabilities. Experienced bank loan officers know that they need to know what is the net cash flow after servicing all financial obligations.

About 2005, employees in the Ministry of Finance were directed to conduct as much of their sourcing of new monies by using external contracting (provided to me by a retired Ministry officer). As a way of clarification you could also do as I did and ask the then AG two questions. The first was why the term “debt” did not apply to long-term contracts? The second was to be assured there was no double counting of what “Contractual Obligations” showed and what “debt” showed. His first answer was, because in the world of accounting “debt” describes a very specific obligation. His second answer was, that there was no double counting so the total of the two equals the total of what we BC citizens owed in the end and had to be paid by either user fees, tolls, taxation, rates and/or proceeds from selling public assets.

So back to your first question. “Contracts” cannot be technically described as “debt” because they do not meet the precise term of what is “debt”. He, the AG, said that several conditions of typical P3 and IPP contracts were performance related. “Debt” has nothing tied to performance, only to passage of time and default or not.

Now, you tell me if the citizens of BC understand these fine distinctions ,because I don’t think they do nor want to.

This is more a “show me the beef ” matter and simply put, how much do we owe and to whom. Since the IPP contracts were deliberately made secret by the government after we got the an IPP applicant and BC Hydro out of the BCUC and into a real court of law, we may never know the last answer. We do know that the “Sea-to-Sky” highway upgrade was done as a “Shadow toll” contract with Macquarie International but since it was sold on a few years ago, to whom we owe we don’t now know.

For the first time this last year saw the BC Auditor General deliver a report that particularly featured “Contractual Obligations”. The previous AG also worried about the scale of this category and made observations about these numbers. Arthur Hadland specifically drew the province’s credit rating agency to the matter of “Contractual Obligations” and they responded that these amounts were included in their assessment of the BC Credit rating. Since then Moodys have mildly reprimanded the government with no disernable difference in Liberal practices.

Please don’t show me anything from V. Palmer, he is not an inform journalist or a least does not write like one.

Mike if you dont think a “contractual obligation” is debt…..

try selling your car to someone while you still owe money to the bank for it…………

Info from BC Hydro’s Revenue Requirements Application (RRA) to the BCUC:

– Hydro’s 10-year rate plan, announced in 2013 before Site C approval, calls for annual rate increases of 9, 6, 4, 3.5 and 3% for the first 5 years, for a cumulative total of 28.1%. For the final 5 years Hydro forecasts 2.6% a year. 10 year cumulative total = 45.6%. The 3.5% increase in year 4 took effect Apr. 1, 2017. The rate rider (to pay off the rate-smoothing regulatory acc’t) remains at 5% throughout.

– Over the 10 years, Hydro’s debt was to go from $16.6 billion in F2015 to $17.3 billion in F2024. This included regulatory/deferral account debts and Site C pre-approval costs of $419 million, which reside in a deferral account throughout the 10 years and with interest grows to $593 million by F2024.

– After Site C’s approval in 2014, all Site C costs are shown as capital expenditures. Hydro has revised its debt projections and debt will now be $24.0 billion in F2024. At that time the rate smoothing deferral account will be at zero. Total owing in all deferral accounts will go from $5.4 billion in F2015 to $3.6 billion in F2024.

– Site C is being built on borrowed money and Hydro has no plans to pay any of it off until the dam is completed in F2024. When asked what rate increases will be after F2024 in order to pay off Site C, Hydro refused to speculate.

I thought it would be fun to provide the curious with a story from the internet about how governments do things to make people think that matters are just fine. I gave one example already about the humungous amount described as BC Hydro assets when in reality they are monies we still owe, like $6 billion. The development of a country or provincial gross domestic product number is technically supposed to measure the value of real annual output for each jurisdiction.

Now just ask yourself if it is reasonable to consider the winnings from gambling? I hope your sitting down because the answer is yes even though there is not a single aspect of gambling that could be considered as vital to sustaining life on this planet. If that were not enough, in May of 2012, the Italians decided to count prostitution, gambling and smuggling in an effort to bulk up their GDP. Don’t ask how they determined values.

Enron was one of the ugliest US frauds of the last century, so who does our BC government do business with, the refugees from that corrupt enterprise.

For anyone truly interested in the use of fictional economics, read M. Hudson’s most recent book.

Don’t forget that the last time BC had a surplus budget was when the NDP was in power.

Since theBC Liberals lied their way into power, we have had deficits.

Your article and the facts presented would be front lede of every media each and every day if the NDP were doing this.

Thankfully some but not nearly enough discovered near the tail end of the 2015 federal election how corrupt Cdn media has become. That Postmedia et all are not journalism any longer. Media is owned by corporate interests whose first interest is in manufacturing consent for the fossil fuel energy industry.

BC media ignores, twists, spins and ignores what these Clark Cons are doing. This election the spin is back again full bore.

Notice how they question how the NDP would pay for their mandate promises but have never outed bankrupting Hydro in so many ways (raid it, IPP’s, deferrals, Site C ), ICBC, etc.

BC media has never asked how this govt will pay for things… ever. BC’s historic record debt has never been mentioned… swept under the rug.

If BC media was even 1/2 way in integrity, the voters would have tossed this foul corrupt nest of asset strippers out.

Btw: not an NDPer. Non-partisan. Hate corruption in any form.

BC media should be outed Nationally.

The Liberals created the problem, Norm doesn’t like the Greens, and the NDP have promised against all logic to freeze rates. Guess I’ll vote for Erik!

I’d vote for Erik too, Harry!

That makes three of us!

Unanimous!

Erik for Premier.

He lost me when he stated that the Norwegians do things differently than BC. You can’t compare the economies and policies of a country with that of a province within a country. That would be like comparing the economy of the region of Western Norway to the economy of the country of Canada. If he doesn’t understand that, then anything else he says is suspect.

Sorry to leave you in this bad state Monna. I guess I just could not resist the comparison because it is so stark.

Unlike Sweden next door, Norway does not have the mineral reserves, also unlike BC. Unlike BC , Norway does not have the agricultural capacity as well. Both have had great fisheries. What the cautious Norwegians have that we in BC have never seemed to have is the understanding that harvesting non-renewable resources, like oil and natural gas, is something to save revenues from for the day they run out.

As David Hughes has shown, and totally unlike the Norwegians, our BC government have stood aside , collecting jump change from the production and export of natural gas all the while the production and export numbers have soared. Any fool can sell a lot of anything if they make the price cheap enough.

I am truly sorry if I lost you but then again maybe not.

Thank you for this article and the explanations provided within the responses. The discussion is interesting and makes sense to me (possibly one of those average BC voters). P.S. To nonconfidencevote: “argument” … no “e”. 😉

This is a link to the 5 pages of BC Government Contractual Obligations, totalling over $102 Billion:

http://www.fin.gov.bc.ca/ocg/pa/13_14/Contractual_Obligations.pdf

This is in addition to the roughly $69 Billion Total BC Government Debt.

See P. 140:

http://bcbudget.gov.bc.ca/2017/bfp/2017_Budget_and_Fiscal_Plan.pdf

Total BC Provincial Debt now at about $69 Billion, the plan is for it to go over $77 Billion in 2019/2020.

Adding the two: $102 Billion + $69 Billion = $171 Billion owed by BC Government.

What has been done in this article is to use the figures for total liabilities. The “BC Provincial Debt” is part of it.

Sort of like saying you owe x dollars on your long term mortgage (akin to provincial debt) PLUS other amounts you are obliged to pay like credit cards, car loans, utility bills, bookies, etc.

I am not too fond of the BC Liberals myself, but it’s important to have a critical view on all angles, including this article.

The regulatory assets you speak of are account balances that was taken on and slowly paid off through present and future ratepayers for large expenditures and future demand that are essentially slowly amortized by present rates. This is to smooth out rate increases rather than having a spike in rates all of a sudden and having highly volatile and fluctuating rates. Think of it as taking a couple year mortgage to have those funds available for projects and slowly amortizing that mortgage now and later, as opposed to taking on the mortgage or opening a line of credit and having to pay it off in a much shorter-term and instantly using up that capital—doing it this way would drastically increase your expenses during that period.

Another point worth noting is that table comparing debt, which was found here: https://in-sights.ca/2017/04/10/hypocristy-part-3/. It really limits the credibility when both are somewhat of attack articles, particularly the cited one. With proper reference to an actual source, the vague reference of BC Public Accounts actually stated for March 2016’s debt: “As at March 31, 2016, total provincial debt totaled $65.3 billion – 26.7 per cent of

BC’s nominal GDP” (Source: http://www.fin.gov.bc.ca/tbs/Financial%20and%20Economic%20Review,%202016.pdf, p. 37), and no where near the ~$160 billion in the table. In the same document, contractual obligations are $4.85 billion (p. 44).

Yo Colin.

Never mind the $160 billion in contractual obligations……how much are the Liberals paying YOU?

Is YOUR contract up immediately after the election?

Wishing the facts were other than what they are is ineffective.

Regulatory accounting is acceptable for short term smoothing of sudden variations but, at BC Hydro, it is being used long term to hide results. Throughout earlier years, these accounts would go up and down. For many years, they’ve gone up steadily and dramatically.

The province’s audited financial statements disclose liabilities and, in footnotes since 2006, disclose contractual obligations that are not included in the Statements of Financial Positions. Add liabilities and contractual obligations and you get the numbers charted here and discussed by Mr. Andersen.

It makes no sense to ignore the relatively new form of debt that are contractual obligations. Professional accounting bodies are now preparing changes to GAAP, needed to so these can not be hidden away in footnotes that only wonks read.

Good morning Colin; The focus of my article is total BC provincial liabilities as reported by the Comptroller and Auditor Generals. If you go to last year’s Comptroller General’s annual report , on page 21 you will read the number for total liabilities of $84.332 billion and on page 73, in the AG’s section, you will read $101.438 billion for total Contingencies and contractual Obligations. Several years ago I asked the then AG in writing was there any double counting in these two values and he answered in writing no. Since we are today one year on I am expecting the trend in borrowing and spending to have not slowed down, thereby making the total now above $185 billion , maybe more like $195+ B.

As to the so called regulatory accounts, BC Hydro show them as assets, primarily to escape the statutory requirement of a minimum equity be maintained. Prior to 2005 these accounts were annually settled to zero by the incorporation of the amounts into proper places in the income and balance sheet statements. From 2006 on this deferment of collection grew to now where the totals are greater than one whole year of regular sales revenues.

When it comes to jargon be very wary of terms. Micheal Hudson has a new book on the use of terms to describe conditions in the exact opposite way these terms were previously used. In just one example, BC Hydro uses the term asset for what has been accumulated in the regulatory accounts. From their point of view they are accounts receivable. Since it is the customer of BC Hydro that has yet to pay the $6 billion these are the people who have this financial obligation and if BCH customers can’t or won”t pay it is a liability then of the citizens of BC. This $6 billion is not included in the $185 billion.

Why BC Hydro allowed this to build up this way makes no sense because over the past 10 or so years most of all new electricity generation capacity has been done by the Independent Power Producers who have their own books to record the progress cost of building. If it were otherwise BC Hydro would be booking a growth in fixed assets. We suspect that all the new IPP assets will become the fully paid up productive assets of the IPPs at the end of their contracts with Hydro.

Perhaps you know differently?

Colin, when those contractual obligations stem from sweetheart private power contracts or PPP deals and result in much higher power bills or taxes (inevitably, at the rate we’re going), then they should be thought of as debts. There is no “smoothing out” our or power bills, More like a hockey stick of rising costs to all BC ratepayers.

It makes little difference to future British Columbians – who will pay dearly for this gross fiscal ineptitude, even corruption – whether they pay through the nose on their power bills, MSP premiums, ICBC rates or taxes. The point is that during this era, the government that is supposed to represent the public has facilitated the largest transfer of wealth from British Columbians’s pockets into the those of wealthy donor pals in our history. That’s it – in a nutshell.

Finally, please note that the title of the chart in this piece has been updated to leave no doubt whatsoever of what we speak: “BC Govt Liabilities & Contractual Obligations as reported in BC Public Accounts.”

Thanks for the article, Mr. Anderson. Do you have an updated graph on BC’s debt and contractual obligations? The most recent one I can find is at the bottom of this page:

https://commonsensecanadian.ca/bc-budget-hides-100-billion-liabilities-leaves-citizens-shoulder-debt-burden/

Hi from Erik; I don’t have charts but no worries, Norm Farrell does. There is also a chart by the BC Auditor General that shows the totals for Canada and all provinces showing the amounts for “Contingencies and Contractual Liabilities” for fiscal 2016. I think it is about the second or third to last report they posted and around page 40. Cheers

Excellent article Mr Anderson.

Unfortunately , all your arguements are wasted on the average BC voter who has the 30 second sound bite attention span that the Liberals rely upon to get re-elected…..

My genuine fear is that Christy Clark will be re-elected. Winning with zippy one liners that say nothing.or worse…are outright fabrications…..like a President south of the border learned early in his campaign.

My second fear is that the NDP will be elected and then blamed for the grotesque fiscal mismanagement foisted upon the Province BY the Liberals 15 years + of irresponsible corperate handouts.

I fear for the outcome fiscally, environmentally and generationally. We are dooming our grandchildren to a polluted, bankrupt province that will try and outrace other provinces to the bottom to get “investment” and “Mcjobs”

Excellent ! The obvious answer is to Vote green especially as the leader and present member is so qualified to deal with the problems . and it appears asif those running with him have real value themselves

Vote Green if you want the status quo continued. Rafe Mair has written about Andrew Weaver’s continuing support for this industry which is costing BC Hydro ratepayers hundreds of millions a year.

An example:

https://commonsensecanadian.ca/rafe-weaver-bc-greens-backing-private-river-power-sham/

“The obvious answer is to Vote green especially as the leader and present member is so qualified to deal with the problems . and it appears asif those running with him have real value themselves”

Please explain how Weaver is an expert on forensic accounting.

Further and more importantly every human has value. Explain how this will fix the financial obligations at BC Hydro.