I was astonished to read, “A new forecast by BC Hydro shows electricity demand in the province is expected to grow by 50 per cent over the next 20 years,” in a recent article from the Vancouver Sun. To understand why I use the term “astonished”, one must delve deeper to see that this statement is not supported by Hydro’s own data and other global economic data. Rather than taking everything at face value, I’ve learned it’s critically important to question the statements made by BC Hydro and the current provincial government. After watching a documentary on the collapse of Enron and how wild forecasting and lack of genuine oversight led to one of the largest financial failures in modern history, the resounding statement was, “ask why” – wise words to follow to avoid repeating history.

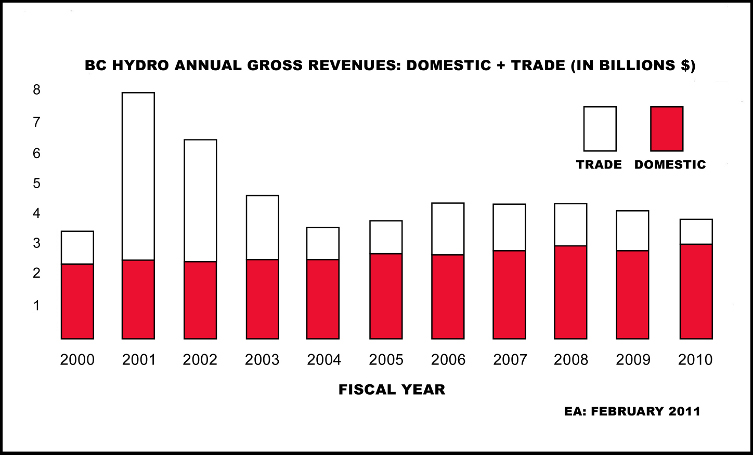

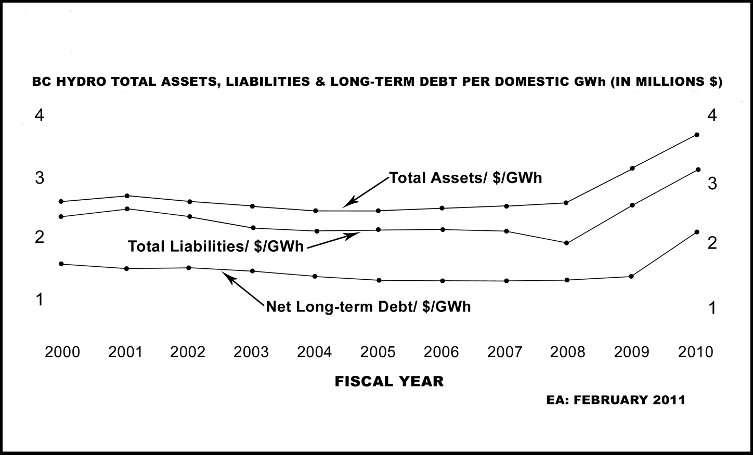

It will be of help to the reader to understand some of the financial implications of BC Hydro’s forecasting. Discussion should start with the understanding of the unit used to measure and report about electrical energy. It is the Gigawatt hour (GWhr) per year, as you can see in the chart that follows. Using the public values associated with the proposed Site C generation plant, it takes $2,000,000 of borrowed money to produce one GWhr/year of usable energy. Keep in mind as you read what follows, your Government and BC Hydro are apparently intent on borrowing and spending, in your name, $30,000,000,000 by 2017. If left to follow the path set out in the most recent BC Hydro forecast, the corporation’s total liabilities will explode to $80,000,000,000! As a shareholder, ratepayer and guarantor of the debt are you ready for this experience?

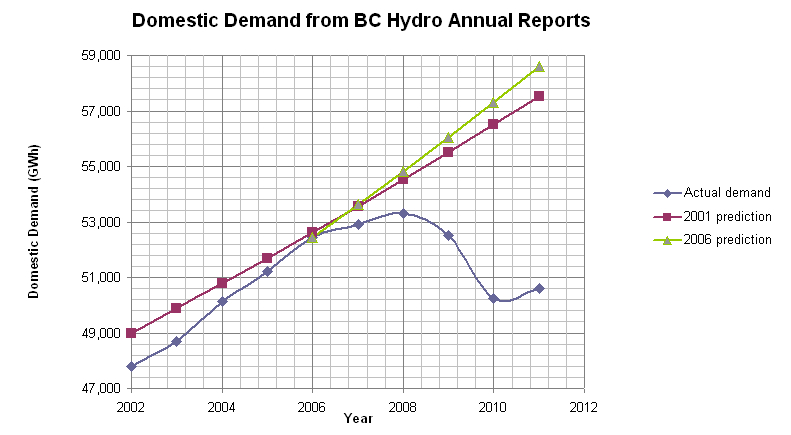

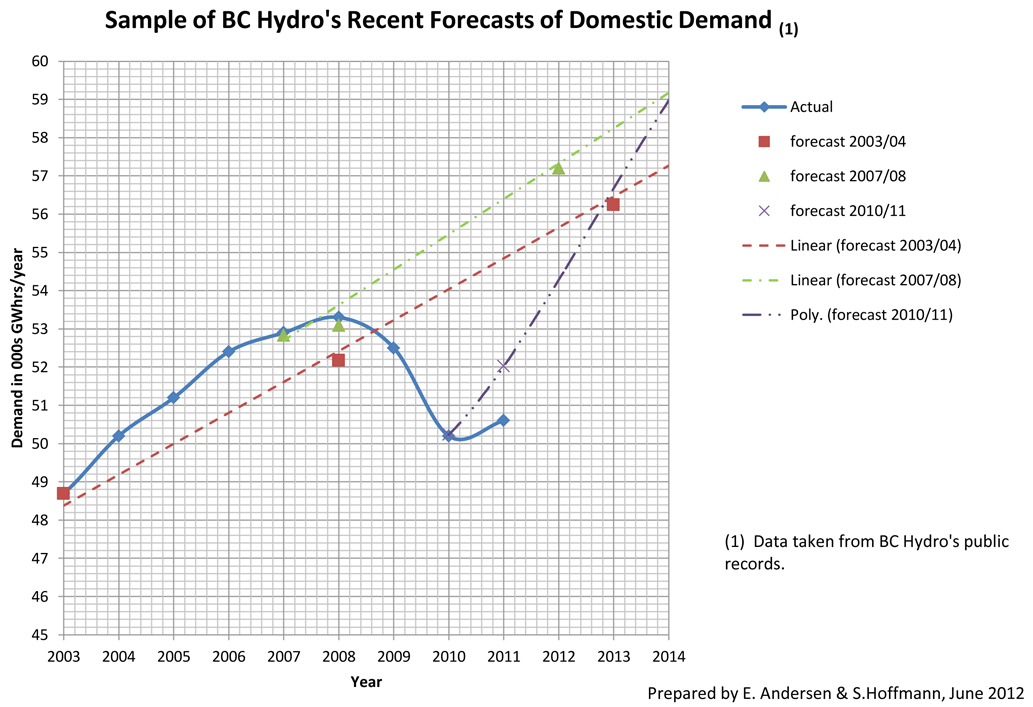

This is an evidence-based discussion, which means looking at actual domestic demand from BC Hydro’s annual financial reports in concert with various historical demand forecasts by BC Hydro. This data is shown in Graph 1, below.

It can be seen from this graph that the domestic demand had a significant downturn starting in 2008 and that we are currently at pre-2005 levels. Comparing BC Hydro’s forecasts with the actual demand clearly indicates how poorly they match up, even failing to predict any degree of decline.

What is arguably even more striking than BC Hydro’s apparently poor forecasting skills is the trend in their forecasting. According to their predictions, the rate of increase in demand is greater for each forecast, illustrated by a sharper rise for each subsequent forecast. This begs the questions as to why this would be the case and if there is any justification for it.

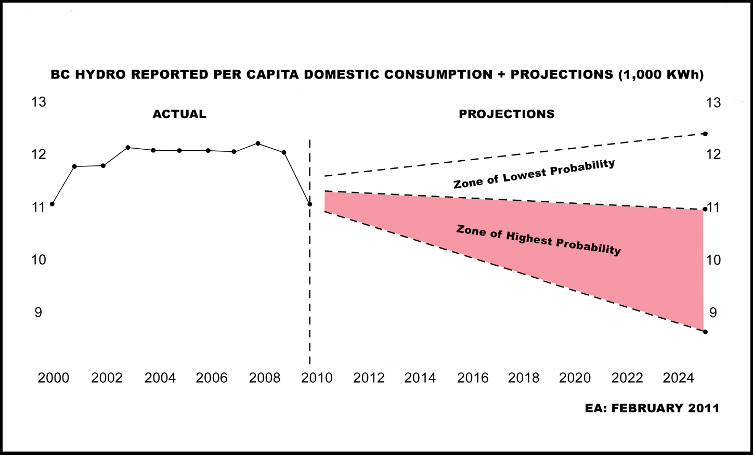

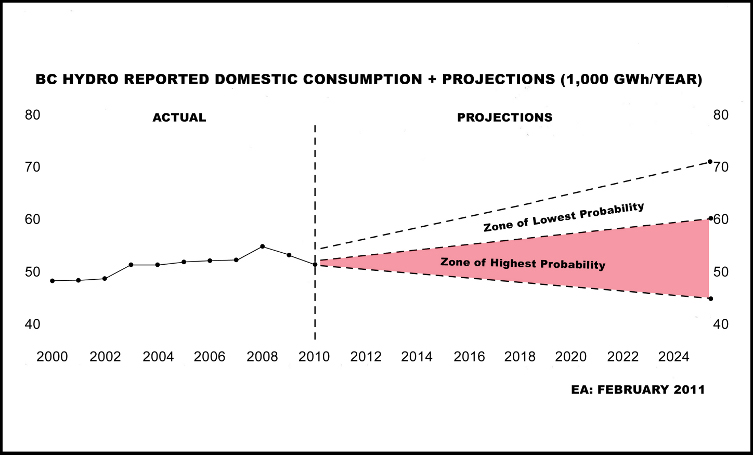

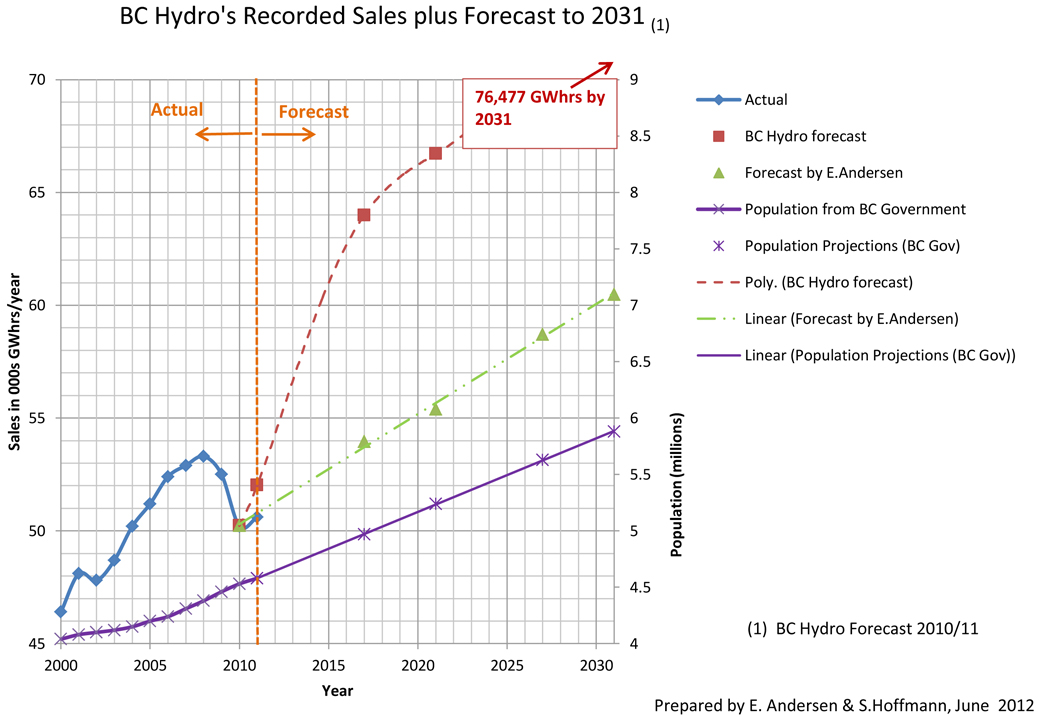

BC Hydro has previously stated that this increasing domestic demand is based on increasing population. However, population growth, plotted in Graph 2, can be seen to be fairly linear from 2003 onward. With the population increasing at a fairly steady rate, one would similarly expect domestic demand to increase at a constant rate, if modelled on population growth. Added to this is the growing recognition that per capita demand for electricity has been declining since 2008. An increasing rate would result from accelerated population growth, which is not the case. This becomes most troublesome with the 2010/2011 forecast, which portrays a dramatic rise in the forecasted rate of increase without the associated population growth to warrant it. What is the justification? There is none – it is a deliberate exaggeration of provincial demand.

Graph 2 includes BC Hydro’s longer term forecast to 2030. In addition, it shows a projection by Erik Andersen that utilizes a per capita demand value for residential plus commercial customers coupled with an expectation of industrial demand. The latter is reflective of new industrial customers having to pay higher than the “legacy rates” that are available to some established large customers.

By presenting an exaggerated need for more domestic generation capacity BC Hydro is giving cover for its call for new Independent Power Producer contracts and for projects like Site C. This is a continuation of a corporate culture documented in the book White Gold by Karl Froschauer.

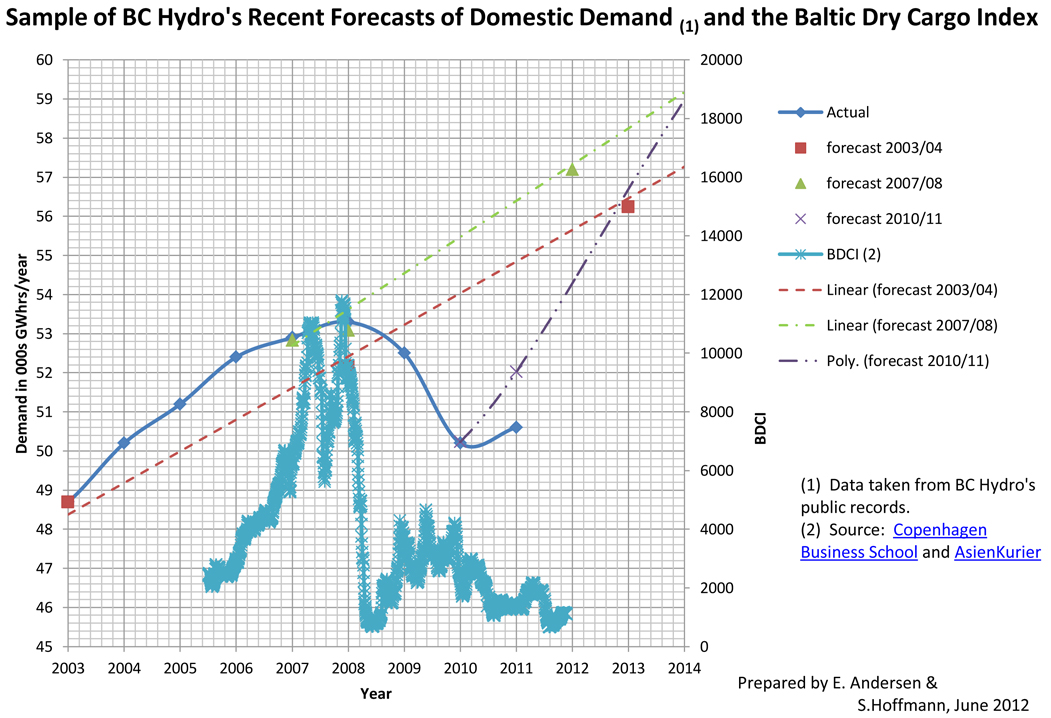

What BC Hydro and the current government are ignoring is the present state of the global economy. Of the many global business indicators available one of the best is the Baltic Dry Cargo Index. This historical index combines dry cargo shipping charter rates with volumes. It is considered by professionals as the only uncontaminated global index because it is not subjected to speculative “gaming”. It is also considered one of the best leading economic indicators available to the public. Graph 3, below, adds the Baltic Dry Cargo Index to Graph 1 (above).

It is interesting to note how closely the BDCI matches the trend in domestic BC electricity demand. To ignore the current global economic climate, which domestic demand appears to parallel, is a seriously large financial gamble.

BC Hydro has a well-documented history of exaggerating demand to serve corporate interests and that pattern is repeating. There is no evidence to support their claim and BC citizens need to start asking “why?” to avoid the blunders of the past reoccurring. In terms of the current state of the global economy, there is trouble out there and you don’t go stepping out into new debt at a time like this.

A recent article in the New York Times has shown that Asia has been “falsifying economic statistics to disguise the true depth of the troubles”, which is why a global indicator such as the BDCI is so important. Folks who aren’t making their “numbers” resort to “Enron-style” information flow. China’s sputtering economy is facing tumbling electricity demand, yet that is largely being hidden.

We must insist on evidence-based projections of demand that take into account the global economy as opposed to wishful thinking on BC Hydro’s part. The latter has the tendency to produce stranded assets at the expense of the citizens of BC.

Sandra Hoffmann is a Ph.D chemist specializing in water chemistry and is the former coordinator for the Peace Valley Environment Association. Erik Andersen is an independent economist and regular contributor to the Common Sense Canadian.