by Susan Jones

The Vancouver Fraser Port Authority, commonly known as Port Metro Vancouver (PMV), is moving forward with plans to extensively dredge the environmentally-sensitive estuary of the Fraser River to build another man-made island for a new terminal with 3 container berths. The island will be 115 hectares (284 acres) plus an intermodal yard and a widened causeway with road and rail expansions. The Project will impact 210 hectares (519 acres) of internationally-significant fish and wildlife habitat at Roberts Bank. There is no economic or environmental justification for Port Metro Vancouver (PMV) to proceed with these plans.

Port Metro Vancouver claims:

– B.C. Container traffic is expected to double over the next 10 to 15 years (2.9 to 5.8 million TEUs)

– Throughput for PMV and Prince Rupert will almost triple (i.e. 9M TEUs) by 2030

However looking at the facts:

– Port Metro Vancouver experienced zero net growth in TEUs from 2007 to 2011, with a 14% decrease in 2009. PMV has been handling about 2.5 million TEUs annually since 2007 with 2.1 in 2009. There has been little growth in demand for several years. The world economic situation for containers is uncertain. PMV needs to justify the growth forecasts.

– Prince Rupert is an expanding container port which handled .4 million TEUs in 2011.

– Existing BC port facilities are operating at about 60% of utilization – PMV is operating at about 57% utilization. Approximately 70% of laden containers coming to the Lower Mainland are destined for elsewhere in Canada. Approximately 10% are destined to the United States and 20% are B.C. bound.

– If there is growth, PMV and Prince Rupert have plenty of capacity without building a second terminal at Roberts Bank. With improved efficiencies and planned expansions in the inner harbour and Prince Rupert, the ports will be equipped to handle 9 million TEUs by 2020 and at least 11 million by 2030. This level of capacity can meet PMV’s most aggressive forecasts for 2030 container traffic. This is all without Terminal 2 at Roberts Bank.

– A double increase would require a Compound Annual Growth (CAGR) of 7% which is not happening. The current CAGR is less than 2%

– A study commissioned by Port Metro Vancouver shows the PMV is looking at the highest case scenario of growth which is unrealistic:Preliminary Container Traffic Projections for Port Metro Vancouver: 2011 to 2030 – May 27, 2011 by Worley Parsons Canada.

– The current PMV statement is based on the “high case” forecast. To date, PMV has not even realized the “low case” forecasts.

– The “low case” projection for 2011 was 3.02 million TEUs for PMV and Prince Rupert. The actual business for 2011 was 2.9 million TEUs (2.5 for PMV and .4 for Prince Rupert).

– The lowest case projections for the Deltaport Third Berth in 2006 have not been realized. PMV forecast 2.8 to 3.5 million TEUs by 2010. This has still not been achieved.

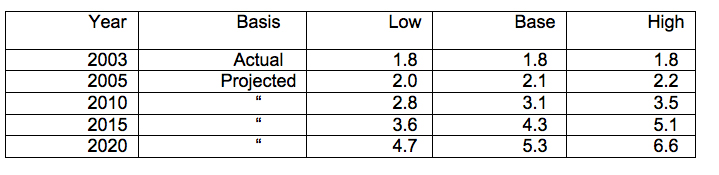

Deltaport Third Berth Project Comprehensive Study Report, July 2006, page 37: The following forecasts, in TEUs, for the Vancouver Port Area, are set out in Table 6:

Note: These figures do not include Prince Rupert. In 2010 and 2011 PMV handled 2.5 million TEUs, well below the lowest cast forecast of 2.8 million TEUs. In fact, PMV handled 2.5 million TEUs annually from 2007 until 2011 (with a drop to 2.1 in 2009). It appears that there will be some increase in 2012 but still the compound annual growth will only be 2%.

– The Worley Parsons Study of 2008 made forecasts of 5.53 million TEUs to 7.87 million TEUs by 2030 for Port Metro Vancouver terminals (does not include Prince Rupert). There is already capacity to handle 5 million TEUs in BC. With planned upgrades at Centerm and efficiency improvements, the capacity can easily reach 7.8 million TEUs by 2030. The Port of Prince Rupert has capacity for 750,000 TEUs with plans for 2 expansions which will increase capacity to 2 million TEUs and up to 5 million TEUs respectively.

Prince Rupert and Port Metro Vancouver can build to a capacity of 11 to 12 million TEUS by 2030, without ever building Terminal 2. With a current need for 2.5 to 3 million TEUs, there are plenty of options for gradual growth, if it occurs.

– The Worley Parsons Study of 2008 did not:

- study in any depth the impact that Prince Rupert port will have on demand in Vancouver

- consider a scenario of continued lower growth due to the global economic situation

- explore options for enhancing supply of terminal capacity at the existing Vancouver terminals

- compare the economic and environmental costs of various options for capacity expansion in the region

– The results of the May 2011 Worley Parsons container traffic study have been over-stated to try and justify the need for Terminal 2.

– The market study by Worley Parsons is inadequate to justify a $2 billion project

– Alternatives can be undertaken at dramatically lower economic and environmental costs

– Economically it is cheaper, and environmentally sensible, to carry out earlier plans for expansions at Centerm and perhaps Vanterm in the deep sea Vancouver harbour before dredging internationally significant habitat at Roberts Bank in the Fraser River estuary.

– Terminal 2 at Roberts Bank is estimated to cost $2 to $2.5 billion. Port Metro Vancouver requested bids in 2008 and selected a joint venture between APM Terminals North America and SNC-Lavalin (APM Terminals/SNC-Lavalin), as the preferred proponent for the Terminal 2. None of the bidders was willing to fully fund the project and Port Metro Vancouver may have to find at least $1 billion to fund the project.

– Funding Terminal 2 initial works without operator commitment opens huge new risks for PMV, including unlimited cost exposure, unfair competition claims and unaccountable use of public assets.

– Currently there are about 600,000 containers (TEUs) going through BC ports that are US bound. If the same US/Canada mix applies going forward this could increase to as much as 1.6 mill TEUs. The US has already expressed concerns about BC ports handling US traffic. It could be argued that T2 is being justified solely on the US bound traffic.

– Port Metro Vancouver is moving forward with the Terminal 2 Project without a proper cost/benefit analysis and without credibly considering alternatives.

– Worldwide there is a new focus on shorter logistics chains to reduce the environmental footprint. The newly dredged and enlarged Panama Canal is scheduled to open in 2015 which will dramatically affect the container trade business on the west coast of North America.

– The new Panama Canal will be the epicenter of a strategic supply chain shift. According to Jones Lang Lasalle, 25% of imports currently coming through the West Coast could shift to East Coast ports as a direct result of the Canal expansion. In fact, the firm cites the Panama Canal as one of the five most compelling change agents in the supply chain going forward. Port Metro Vancouver could therefore lose as much as 600,000 TEUs annually.

– Canadian West Coast container business is important and should be executed with overall planning of best options. Instead, Port Metro Vancouver competes with Prince Rupert and favours Roberts Bank over the other lower mainland ports, namely Vanterm, Centerm and Surrey Fraser Docks. PMV also fails to form partnerships with inland terminals which provide ample industrial land. Ashcroft Terminals is a viable option which is a crossover area for CP and CN railways and it has plenty of industrial land with appropriate infrastructure.

– Port Metro Vancouver is ignoring recommendations from a 2008 study commissioned by David Emerson, federal Minister of Trade, Asia Pacific Gateway and Corridor Initiative: Strategic Advisor Report:

- “We recommend that the development of a system of inland terminals as on overall strategy to serve the following purposes:” The document provides 7 purposes including the fact that this would reduce truck traffic and port congestion. (p. 21)

- “We recommend that policy makers develop container capacity in Prince Rupert before making investments in Vancouver, beyond what have been announced to date. We believe that capacity can be expanded in Prince Rupert relatively quickly and such a strategy will allow time for Vancouver to develop solutions to its congestion.” (p. 12)

- “We recommend that the ability of ports to finance expansion be reviewed…there must be an appropriate ability to finance this development, for it includes a significant element of risk. The current structure and rules regarding the financing of ports are completely inadequate.” (p.12)

– Port Metro Vancouver is ignoring warnings from the Department of Fisheries and Oceans that: “there was no possible amount of mitigation projects they could envisage that would compensate for the environmental damage that T2 would cause.” (source:2007 pre-bid meeting for T2)

Terminal 2 at Roberts Bank makes no economic sense and public assets will be exploited to fund an environmental disaster with the wilful destruction of orca, salmon and migratory bird habitat.

Susan Jones is a longtime Tsawwassen resident and researcher on issues related to port and highway expansion in Metro Vancouver.

With the new ‘ mobile pipelines’ …. more oil is being transported via trains over streams etc. & both sides of the fraser river canyon ; you know they’ll need more ports to send it along with the coal…what folly..what’s new eh!!!!!

Let’s not forget this port facility was built to export coal. To see what climate-induced sea level rise due to burning coal will do to the Fraser Delta, go here and choose a modest 3 meters:

http://flood.firetree.net/?ll=48.3416,14.6777&z=13&m=7

Time for PMV to come to their senses. Great fact finding report. Let’s hope they read it and finally agree to leave the port as it is now. JH

This report places a most convincing argument for not building Terminal 2. Good for you to assemble these facts and figures. Now pray public awareness could reach levels sufficient to bring a hault to this most un-necessary and distructive project.

Hmmm… Roberts Bank… Isn’t that where the BC RAIL sell-off occurred… Christy Clark’s FRIENDS must be peeing themselves with joy at this prospect… 😉 WHAT A GOLD PLATED INVESTMENT THAT TURNED OUT TO BE FOR THEM…