I listened intermittently to the Public Proceedings of the Yukon Legislature’s “Select Committee Regarding the Risks and Benefits of Hydraulic Fracturing” held in Whitehorse on January 31 and February 1. The presentations focussed mainly on the minutia of drilling, hydraulic fracturing, water consumption, environmental impacts, regulations, water contamination and so forth. These are certainly valid concerns, but the big picture as to why the BC and Federal governments are pulling out the stops to liquidate the natural gas resources of BC and the southern Yukon and NWT at an unprecedented rate, and the implications of doing so, were not discussed.

I particularly focussed my attention on the final presentation by the National Energy Board (NEB) and the questions following it. As Canada’s energy regulator with responsibility for future Canadian energy security I hoped I would hear a rational explanation for its BC LNG export approvals totalling more than Canada’s current production, which, if they were to come from BC, would require more than quadrupling current production. I was sorely disappointed. Instead NEB presented a rendition of the process of hydraulic fracturing and assurances of the NEB’s good work on the regulatory front.

The Elephant: Scale, environmental impact and energy security

During the NEB Q&A, when the public’s questions finally came up, 20 minutes before the end of the two-day session, several questions were posed about the implications of the scale of LNG exports proposed by the BC Government and approved by the NEB.

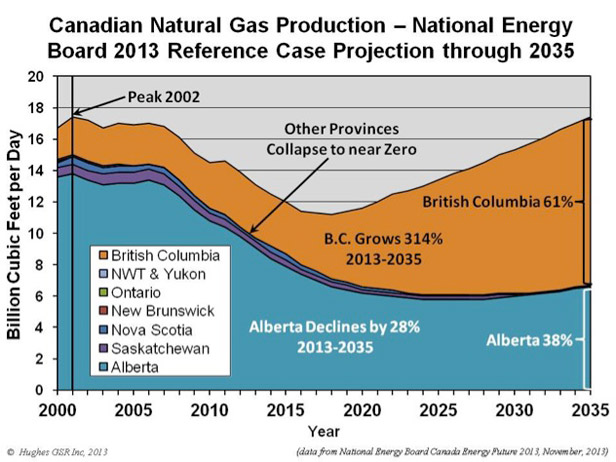

Given that most of the proponents for LNG export terminals approved by the NEB utilized a single Calgary-based consultant for their supply forecasts, one of the questions asked “how reliable is this consultant for future supply forecasts?”. The NEB’s Patrick Sprague declined to comment on the reliability of the consultant and responded that the NEB had its own forecasts published on the web (Canada’s Energy Future, published November, 2013). It’s worth comparing the two.

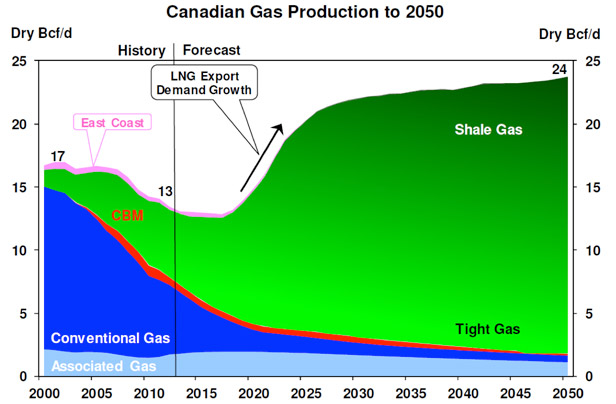

The consultant, in the employ of Aurora Liquefied Natural Gas Ltd. – wholly owned by China National Offshore Oil Corp. and Japanese companies – came up with a remarkably rosy supply picture to justify Aurora’s LNG export aspirations. The consultant suggested that a miraculous turnaround of Canada’s long-standing production decline will nearly double Canada’s gas production by 2035, thanks to shale gas and tight gas (Figure 1). The consultant does not provide justification for its forecasts beyond stating:

[quote][We maintain] proprietary gas production spreadsheet models for each major gas basin and key gas types in North America which use key input parameters to forecast the annual average gas production for each supply source to 2050.[/quote]

In short the consultant says “trust us”. Others might say “follow the money” – who is paying this consultant and what conclusions are in the best interests of its clients? The consultant’s conclusions are certainly in the best interests of its clients and are opposed to other analyses of the “shale revolution”.

This supply forecast is much more optimistic than even the NEB’s reference case projection, which is 20% lower in 2035, despite an assumed four-fold increase in BC gas production (Figure 2).

Projections ignore reality of peaking shale gas production

How credible are the supply forecasts prepared by this consultant and included in most of the export applications the NEB has approved? They belie what is actually happening with shale gas production in the US and what is likely to happen in the future with production and price.

With the exception of the Marcellus play in Pennsylvania and West Virginia (and associated gas from tight oil plays like the Bakken and Eagle Ford), major shale gas plays have peaked and are declining. The Haynesville play in Louisiana and east Texas is down nearly 35% from its peak just two years ago when it was the biggest shale gas play in the US. Other plays like the Barnett, Fayetteville and Woodford are also declining. As a result overall US gas production is flat, and Canada’s production is declining. Forecasting a radical increase in production, at low prices, to accommodate its client’s LNG export aspirations, as this consultant does, is not credible.

LNG exports mean 72% more than total current Canadian gas production

The NEB has approved seven export terminals with a total capacity of 14.6 billion cubic feet per day (bcf/d). If the Aurora proposal is approved that will add a further 3.1 bcf/d for a total of 17.7 bcf/d of exports. Coupled with BC’s current raw gas production of 4.2 bcf/d that would require BC to produce nearly 22 bcf/d, which is 72% more than all of Canada’s current production.

My analysis estimated a conservative 50,000 new gas wells to meet just 14 bcf/d of exports, which would amount to tripling the 25,000 wells that have been drilled since the 1940s and quintupling the amount of gas produced since then. Questions posed at the hearing on what the environmental implications of fracking a well are one thing – drilling 50,000 of them are another. And what about the long term energy needs of the rest of Canada?

LNG exports could mean higher gas prices at home

Another important question posed during the Q&A to the NEB was what the price impacts might be on North American gas of LNG exports. Current NYMEX prices are nearly triple what they were in mid-2012, yet production is flat overall and falling in several major shale gas fields. Production can only resume rising with considerably higher gas prices. The Clark government’s plan, however, is to capitalize on the differential between the currently cheap North American gas price and the price of LNG in Asian markets. Given that the cost to liquefy, transport, and regasify a thousand cubic feet (mcf) of gas is about $6.00, the cost of the gas itself is about $4.50, and the price in Asia is $14.00 or more, there is a potential profit of $3.50 per mcf. If the domestic price of gas rises, as it must to avoid production decline, the profit margin disappears along with all the revenues for the “Prosperity Fund” and debt-paydown touted by the Clark Government.

The increased demand for natural gas in the US for power generation (given shutdowns of coal plants and nuclear stations), and for industrial uses, mean that US and Canadian LNG exports can only further strain supply and increase upward pressure on prices.

Regulators, governments missing the big picture

The attendees at the “Select Committee Regarding the Risks and Benefits of Hydraulic Fracturing” hearings were well served on the details of hydraulic fracturing but the bigger picture of the wisdom of this unprecedented scale-up in extraction and what it means for the long term energy security of Canadians – The Elephant – was largely ignored. This is to our peril given the non-renewable nature of the resources being exploited, the scale and rate of extraction envisioned, and the need for these resources for the foreseeable future as inputs to Canadian energy requirements.

Excellent article! Add to that the hidden costs of carbon pollution, and subsidies to Canada’s fossil fuel industry ($1.2 billion in 2012 or about $787 for a single taxpayer and roughly $3000 for a family of 4).

It further underscores why Canada’s Citizens’ Climate Lobby is pushing for a federal carbon tax. CCCL is non-partisan and action oriented …its mandate is to create the political will for a stable climate. It involves writing to and building a relationship with, your MP and your local editorial boards).

If you are interested in joining a local chapter, or starting one in your area, have a look at the website of Canada’s Citizens Climate Lobby.

Excellent work as always by Mr Hughes.

Its important British Columbians get their head around what is occurring as there is still time to approach the NEB and Cabinet about approving these massive liquidation proposals.

While it is true that a myriad of proposals from oil and gas to site c and beyond have overwhelmed the traditional organizations involved in such matters, nothing is more important to BC’s future than these key developments.

Let the Harper Cabinet know how you feel about his government and the BC Liberals “locking in” for generations the massive liquidation of our resources at rock bottom prices.

See here for details and contact: https://commonsensecanadian.ca/bc-lng-bigger-tar-sands-export-licences-face-cabinet-review/

Low temps down to -20 or -30 C in the BC interior all this week.

Maybe we might like to save some of our BC natural gas, for people in BC to heat their homes in winter.

Maybe we might want to think about using our natural gas in BC as a transport fuel, rather than using gasoline that comes from the Alberta oil sands.

Maybe we should invest our money in alternative, renewable, clean energy, such as geothermal, tidal, wind and solar instead of fossil fuels that our Neanderthal governments are so enamoured of.

Maybe we can fire all politicians and fill some of the vacancies with business managers who are fully experienced in their fields of expertise.