The following is a July 15 open letter to Premier Christy Clark from the District of Hudson’s Hope – near the location of the proposed Site C reservoir.

Dear Premier Clark,

Re: British Columbia Utilities Commission Review of Proposed Site C Dam Project

I am writing to urgently request that you refer the proposed Site C Dam Project to the British Columbia Utilities Commission (BCUC) for further review of project costs, alternatives to Site C, and related issues prior to making a decision on this project.

Prudent fiscal management requires further review of Site C

The District of Hudson’s Hope, a community of 1,100 people in the heart of the Peace River Valley, will be more adversely impacted than any other municipality by the proposed Site C dam.

Understandably, we wish to ensure that these adverse community and environmental impacts and the $7.9 billion cost of the proposed Site C project are justified and necessary for meeting British Columbia’s future electricity needs.

The proposed $7.9 billion Site C project may also be the largest provincial public expenditure of the next 20 years, adding over 10% to our growing $62 billion provincial debt. BC taxpayers, whether they live in Hudson’s Hope, Penticton, Surrey, Comox, Coquitlam, Prince George, Vancouver, Delta, Victoria or any other BC community, reasonably expect the government to subject Site C project costs and alternatives to open, rigorous and independent review with full procedural safeguards before committing to such a large capital expenditure.

[signoff3]

Rating agencies such as Moody’s call this prudent fiscal management. When Moody’s reaffirmed B.C.’s triple-A credit rating in May of this year, it was accompanied by a negative outlook due to accumulation of provincial debt. Moody’s said:

[quote]The negative outlook reflects the risks to the province’s ability to reverse the recent accumulation in debt given a softened economic outlook, weaker commodity prices and continued expense pressures.[/quote]

What better way to demonstrate prudent fiscal management than to subject Site C project costs and alternatives to open, rigorous and independent scrutiny by the BCUC?

Yet this is not what has happened – at least to date. The Site C Joint Review Panel (JRP) was prevented by a combination of BC law, public policy, terms of reference, and a lack of information from fully scrutinizing key project elements including project costs and alternatives to Site C (1).

However, this did not prevent the JRP from flagging its concerns about project costs: “The Panel cannot conclude on the likely accuracy of Project cost estimates [by BC Hydro] because it does not have the information, time or resources. This affects all further calculations of unit costs, revenue requirements and rates.”

Or asking questions about alternatives such as natural gas:

[quote]Finally, if it is acceptable to burn natural gas to provide power to compress, cool, and transport B.C. natural gas for Asian markets, where its fate is combustion anyway, why not save transport and environmental costs and take care of domestic needs?[/quote]

To ensure proper scrutiny, the JRP recommended on May 1st, 2014 in its 457 page final report that a number of matters be referred to the BCUC for further review (2).

The JRP noted,”… available resources could provide adequate energy and capacity until at least 2028″ and accordingly there is time available for the BCUC to do this work. However, Minister of Energy and Mines, Bill Bennett was quick to dismiss further scrutiny. On May 8th, 2014, the same day as the report’s public release, Minister Bennett said:

[quote] …I think that the work has been done and I think subjecting it to another review after all the years the project has been studied is not a good use of public money …[/quote]

Madame Premier, this defies prudent fiscal management. BC needs to complete its homework on Site C.

Hudson’s Hope, BC taxpayers and rating agencies such as Moody’s need to be fully satisfied that this $7.9 billion project will not be characterized as a white elephant that transformed the beautiful Peace River Valley into a dam reservoir, increased the provincial debt by over 10%, and put BC’s strong fiscal management record at risk.

Urban Systems report supports need for BCUC review

Recognizing these major uncertainties, the District of Hudson’s Hope retained Urban Systems Ltd. to review the findings of the JRP Report, and compile information from the proposed project’s Environmental Impact Statement, BC Hydro’s Integrated Resource Plan, and other relevant resources and data to examine the following key question:

[quote]Are the anticipated community and environmental impacts, and high-costs of the proposed Site C project justified and necessary for meeting British Columbia’s future electricity needs?[/quote]

We are attaching a copy of the Urban Systems report entitled, “A Review of the Proposed Site C Clean Energy Project: Exploring the Alternatives” for your consideration.

The JRP concluded that BC Hydro has not fully demonstrated the need for this project on the timetable set forth and Urban Systems has also concluded that a commitment to the proposed Site C is project is likely premature: “The material cited within this document suggests that a commitment to the proposed Site C project is likely premature before the British Columbia Utilities Commission undertakes a review of the proposed project costs and long-term energy needs, including the comparative costs and benefits of potential alternatives. And as the JRP notes there is time to do this work.”

Urban Systems reviewed 5 alternative scenarios to Site C including retrofits and upgrades, geothermal, other renewables and enhanced demand side management, natural gas/cogeneration, and emerging technologies. Urban Systems concludes: ” … there are likely alternatives which could be cost-competitive and viable to meet future electricity needs.”

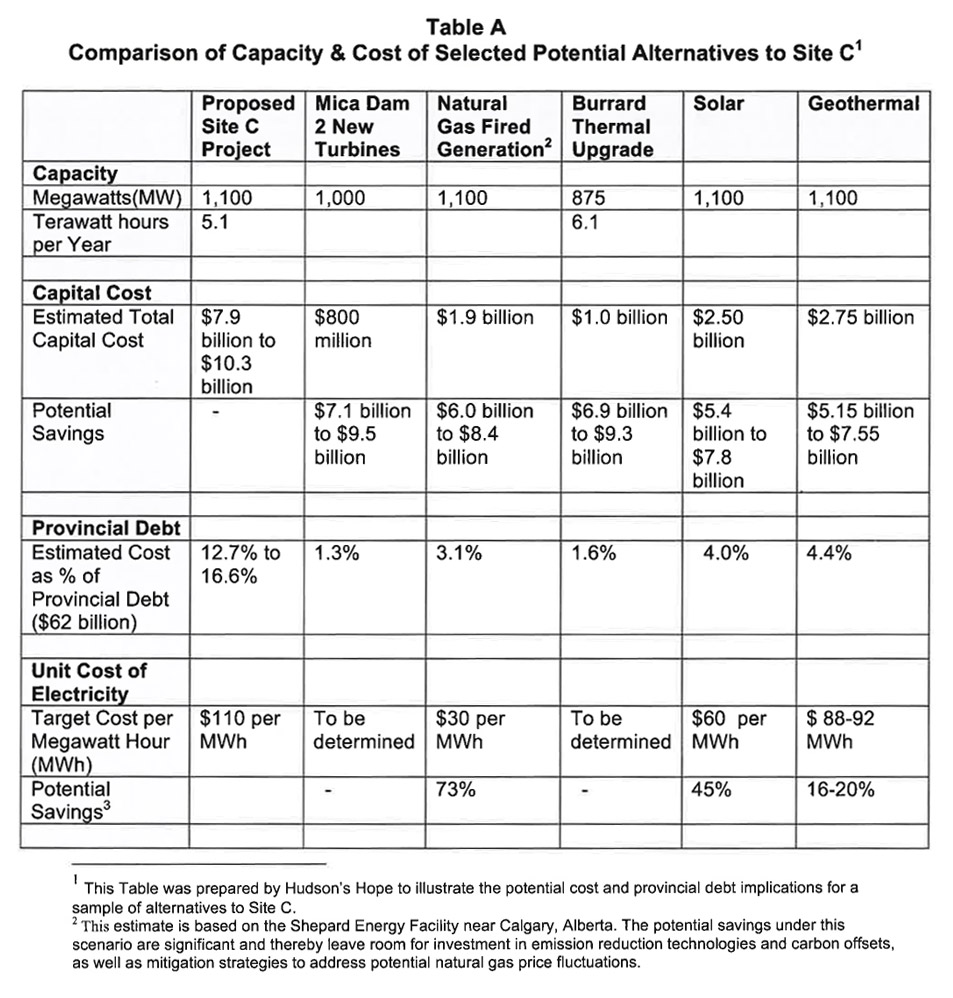

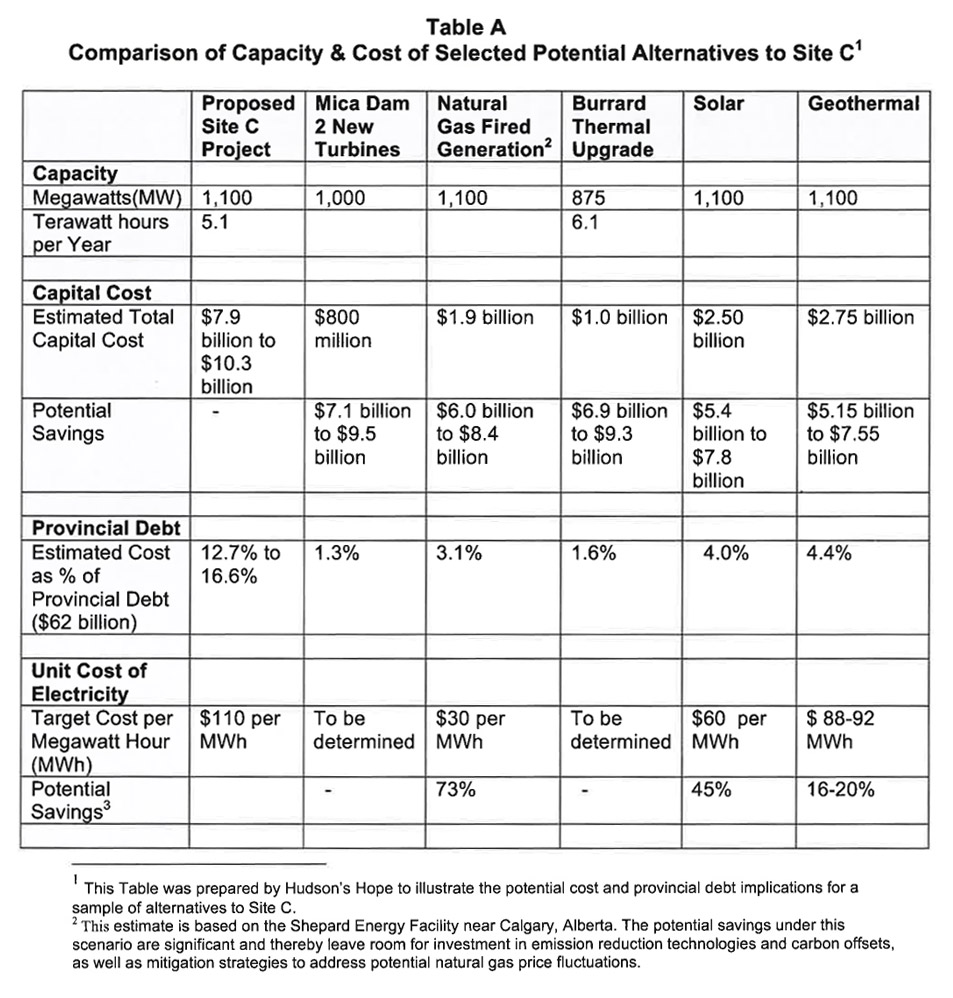

A preliminary comparison of selected alternatives to Site C suggests that BC could pursue these alternatives and potentially save over $ 5 billion in project costs. The “accumulation of debt” by the province would be significantly reduced. Please refer to Table A.

Finally, Urban Systems cautions that emerging trends could result in a risk to ratepayers: ‘

[quote]Three trends are occurring simultaneously that could substantially reduce the need for the proposed Site C project and affect BC Hydro’s forecasted revenues, thus limiting its ability to pay for such an asset over its 70 year amortization period. These three trends include: increases in BC Hydro electrical rates, the decreasing cost of solar photovoltaic (PV) modules, and the commercialization of micro grid enabling technologies.[/quote]

Conclusion

With the benefit of the information contained in this letter, I urge you to do what is fiscally prudent and makes common sense – refer the proposed Site e project to the BeUC for open, rigorous and independent review of project costs, forecasted revenues and less costly alternatives to Site e prior to making a decision on this project.

To do anything less for the largest and most expensive public project in Be in the next 20 years is imprudent, especially for a government that prides itself on its triple-A credit rating. I would appreciate a written response from you by July 31st, 2014.

_______________________________

1 JRP findings:

• The Panel concludes that, basing a $7.9 billion Project on a 20-year demand forecast without an explicit 20-year scenario of prices [by BC Hydro] is not good practice. Electricity prices will strongly affect demand, including Liquefied Natural Gas facility demand.

• The Panel concludes that demand management does not appear to command the same degree of analytic effort [by BC Hydro] as does new supply.

• The Panel concludes that a failure [of BC Hydro] to pursue research of the last 30 years into B.C.’s geothermal resources has left BC Hydro without information about a resource that BC Hydro thinks may offer up to 700 megawatts of firm, economic power with low environmental costs.

2 Please refer to JRP recommendations 46,47,48 and 49.